US traditional casinos drive industry's all-time revenue record $13.6B in Q2

US commercial gaming revenue marked a new industry record in the second quarter of 2021, as it reached $13.6 billion, according to the American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker.

This new mark was 22% up from the previous records set at $11.1 billion in Q3 2019 and Q1 2021.

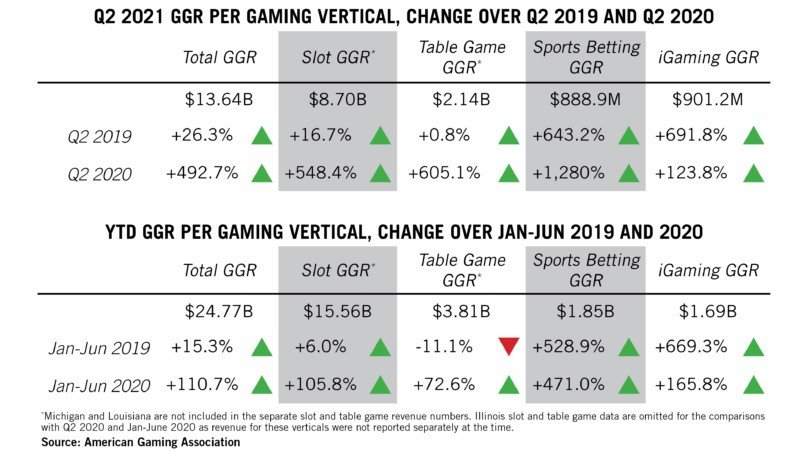

During 2021, the US gaming industry generated nearly $24.8 billion to date, and is close to surpassing 2020 full-year revenue ($30 billion) and on track to overtake 2019 ($43.6 billion) as the highest-grossing year ever for commercial gaming revenue. In fact, Q2 2021 was 26.3% higher than the same quarter of 2019.

While growth in sports betting and iGaming buoyed the gaming industry over the last year, record brick-and-mortar casino revenue, up nearly 10% from its previous high in Q3 2019 to $11.8 billion, was the key driver of the industry’s record-setting recovery. AGA said this is a result of easing capacity and amenity restrictions, coupled with continued consumer demand. While three-quarters of commercial casinos began Q2 capped at 50% capacity or less, nearly every commercial casino had returned to full capacity by the end of June.

“These first half results are truly remarkable. It is even more impressive when you consider commercial gaming revenue was at its lowest point ever just a year ago,” said AGA President and CEO Bill Miller. “This is a testament to our resilience and commitment to providing customers safe environments and world-class entertainment experiences.”

In a press call Tuesday, joined by Yogonet, Miller said that encouraging vaccination rates growth is the key to see restrictions lifted, amid the new coronavirus delta variant spread. In that sense, he noted there are nearly 130 vaccination centers at casinos in 31 states. He added the full recovery still requires the meaningful return of meetings, business travels.

In addition, AGA's CEO said the illegal market is the biggest challenge to the gaming industry's growth, and noted the need to do more on the enforcement side. Miller added the adoption of digital payment is critical with that aim.

When asked by Yogonet about cashless technologies, Miller said Covid-19 and mobility has contributed greatly to regulators in how they view transactions, paving the way to open up digital transactions, and that operators have understood there is a great benefit there, with US federal security entities saying that these cashless payments are preferable in order to track money digitally and tackle AML activity. "There is an evolution taking place both on the business side and regulators side," Miller concluded.

Latest commercial gaming revenue numbers

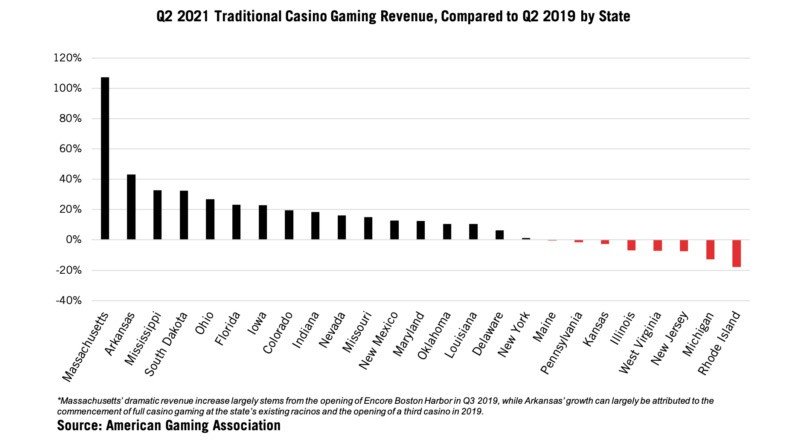

According to AGA's numbers, 22 out of 25 commercial casino states saw quarterly gaming revenue increases in Q2 2021 compared to the second quarter of 2019. The majority (19 of 25) of commercial casino states outperformed their first half of 2019. Also, 17 out of 25 commercial casino states set quarterly revenue records in Q2, including 8 of the 10 highest-grossing states in 2019: Indiana, Louisiana, Maryland, Missouri, Nevada, New York, Ohio, and Pennsylvania.

Sports betting revenue declined 8% from the previous quarter to $889 million due to a quieter sports calendar, but growing more than 600% over the same three-month period in 2019. Despite this, the first half of 2021 has already generated more sports betting revenue ($1.8 billion) than all of 2020 ($1.5 billion). Americans wagered $11.07 billion with legal sportsbooks in the second quarter, compared to $13.02 billion during the first quarter of the year.

iGaming revenue also achieved a new quarterly revenue record of $901 million, up 15% from the first quarter of 2021.

Combined revenue from sports betting and iGaming accounted for 13.1% of total gaming revenue in Q2 2021, down slightly from 15.7% in the first quarter.

"We should all be proud of our collective resilience over the past 18 months. These remarkable numbers reflect the pent-up demand for our one-of-a-kind entertainment experiences and leadership to prioritize health and safety", Miller stated.

“The past 18 months have proven that this industry can persevere through hard times while remaining dedicated to our customers and communities,” added Miller. “COVID-19 is not yet in the rearview mirror, but I’m confident the record first half of 2021 has laid a strong foundation for the industry’s full recovery.”