US social casino apps take record $990M from iOS users at pandemic's height

Mobile app marketing platform Liftoff, and GameRefinery, a mobile games insight and analytics platform, on Wednesday released its mobile social casino apps report, revealing trends in the mobile market. These include record spend in social casino during the height of the pandemic, as well as shifts in platform engagement following Apple’s privacy regulations and key insights into the value of global regions.

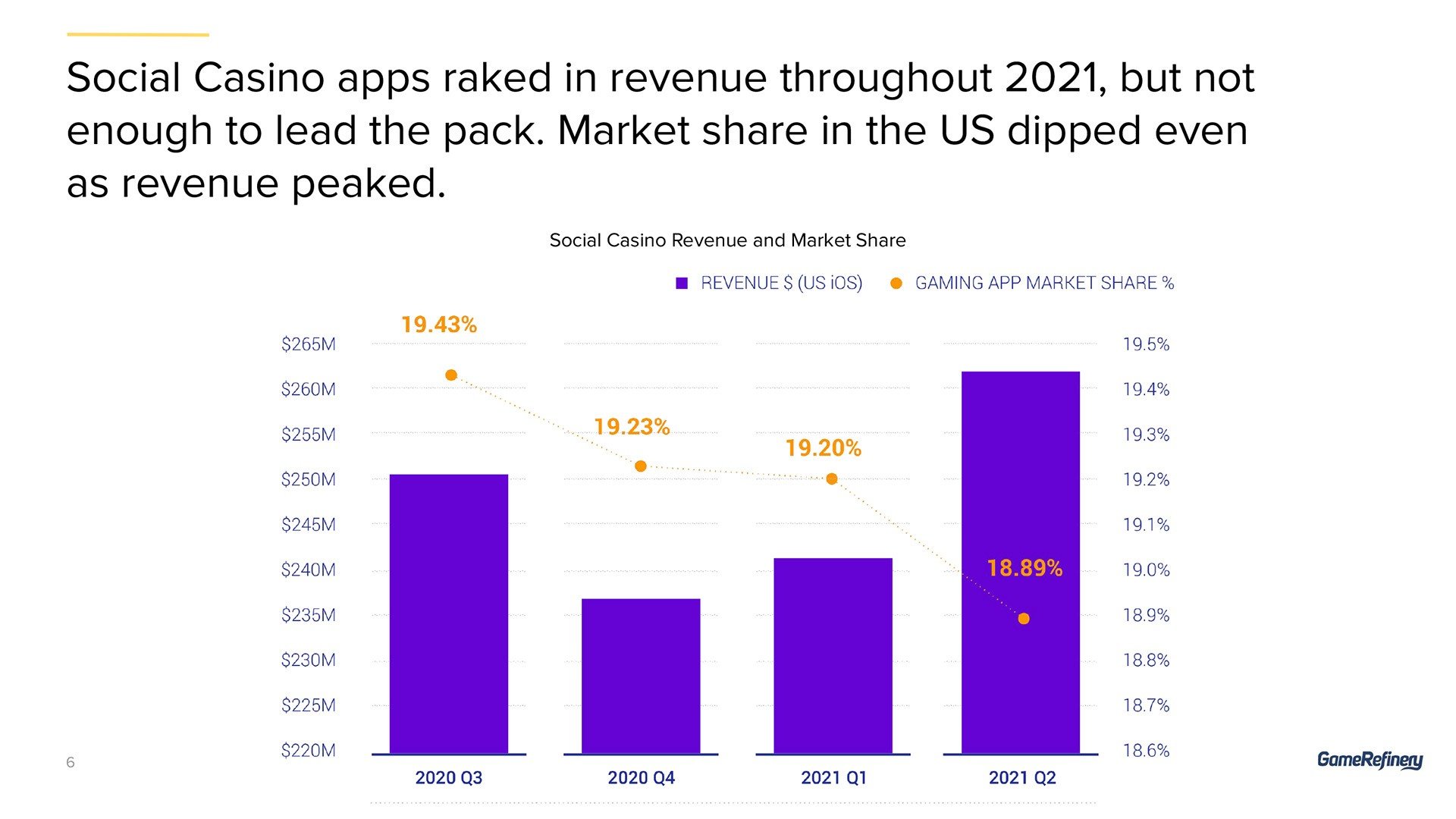

As the pandemic drove a decrease in foot traffic to in-person casinos, social casino titles experienced an uptick. Many consumers took to a new habit of online social casino games, which offer a gambling-like experience without the stakes. According to the report, iOS users in the U.S. spent a record $990 million in social casino apps during the height of the pandemic, Q3 2020 to Q2 2021. Even as vaccinations increased in the U.S. and real casinos in key states were already reopened, the success of social casino didn’t slow down. By Q2 2021, quarterly profits reached a new high of more than $260 million — a particular feat, as the category’s U.S. market share had dropped year-over-year, from 19.43% in Q3 2020 to 18.89% in Q2 2021.

In addition, the report finds that social casino users are older than every other gaming genre, with more than half over 45. The user base is also split about 50/50 men and women, showing that the gaming category has broad appeal.

“As we examine the effects the pandemic has had on gaming, it’s no surprise casino apps are soaring in popularity around the globe,” said Joel Julkunen, Head of Game Analytics of GameRefinery, in a press release. “Since we are seeing more movement in this market, it’s vital for mobile marketers and developers in this vertical to use these insights to inform long-term strategies.”

Furthermore, amid Apple’s recent IDFA (Identifier for Advertisers) policy changes, the report sees Android edging out iOS as the leading platform for casino apps. As marketers adjusting to the post-IDFA landscape shifted their ad spend habits, cost-per-install (CPI) on iOS increased to 9.9% year-over-year, up to $11.09. Meanwhile, Android CPIs dropped 13.7% between August 2020 and August 2021, widening the affordability gap for Android. iOS install costs are now 122% higher than that of Android, compared to 2020’s 74%.

The report also shows Android edging out the competition in return-on-ad-spend (ROAS). While iOS takes the early lead over Android, Android pulls ahead 1.9% by Day 30.

On a regional level, while North America (NAR) shows great engagement, reaching those engaged users comes at a cost. At $10.37, CPIs are the highest of all global regions. Asia-Pacific (APAC), meanwhile, offers a CPI half that of NAR, at $5.68. The regions aren’t far off on 30-day ROAS, with NAR (26.47%) only slightly outperforming APAC (21.8%). "Marketers looking for great value may want to consider expanding their sights to gamers in APAC, as the up-and-coming market shows great promise," the companies conclude in the release.

The 2021 Social Casino Report draws from Liftoff+Vungle and GameRefinery’s internal data from August 1, 2020 and August 1, 2021 — which spans 83 billion ad impressions, 1.1 billion clicks across 239 different apps, 12 million installs and 39 million events to deliver ad performance insights to show how marketers can get the most out of their games.