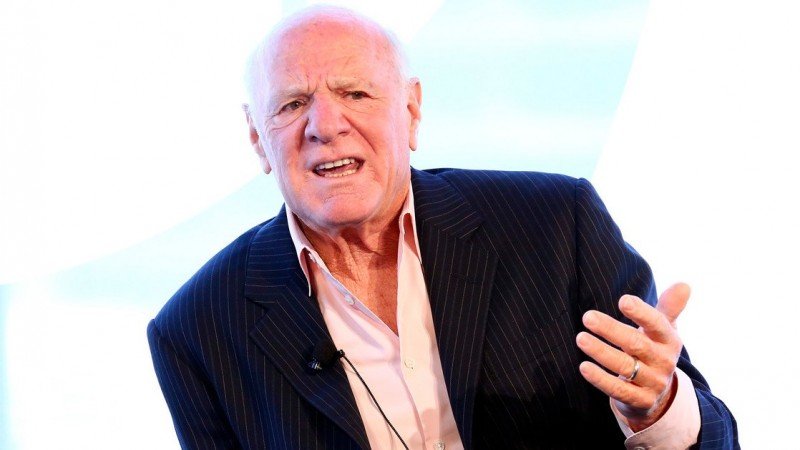

MGM stock boosted by Barry Diller’s IAC $1B investment

Barry Diller’s media and technology company IAC/InterActive Corp said on Monday it has bought a 12% stake in MGM Resorts International for about $1 billion, sending the casino operator’s shares soaring 14%.

“We could not be more excited to welcome IAC and Mr. Diller as an investor in MGM Resorts,” Paul Salem, MGM Resorts Chairman of the Board of Directors, said in a press release. “IAC’s family of brands and digital expertise are a great complement to the direction MGM Resorts has been taking both in leveraging our digital assets to enhance our guests’ experience and building a leading iGaming and sports betting business in BetMGM.” Salem also noted that “data-driven, digital and customer-centric innovations” are a key part of MGM’s 2020 plan announced last year.

The investment came after the internet company Match Group separated from IAC, allowing InterActive Corp. to emerge with roughly $3.9 billion in cash and no debt, according to a statement from the company’s chairman, Barry Diller.

The investment comes at a time when the gambling industry has been impacted by government restrictions on movement due to the COVID-19 pandemic, as well as fears about public gatherings. MGM reported a 91% fall in revenue in the latest reported quarter and has slashed its dividend to weather the impact of the health crisis on its financials. Shares of the company have sunk more than 35% this year.

MGM’s online gaming business, which currently constitutes a small portion of its revenue, was what initially attracted Diller, the billionaire told shareholders in a letter, as reported by Reuters. “MGM presented a ‘once in a decade’ opportunity for IAC to own a meaningful piece of a preeminent brand in a large category with great potential to move online.” Diller added he has followed the online gaming space for a while, looking for an opportunity to enter the $450 billion global industry.

"IAC's expertise in growing and expanding brands online is a natural fit for our focus on enhancing the resort experience through curated and personalized offerings, as well as digital enhancements in sports betting and online gaming," said CEO and President Bill Hornbuckle. "We appreciate that they share our long-term strategic vision for growth and maximizing value for our shareholders. We welcome their collaboration and are excited at the possibilities it will bring."