CT Lottery Chair: "Connecticut will be an impressive driver of sports betting revenue for a state its size"

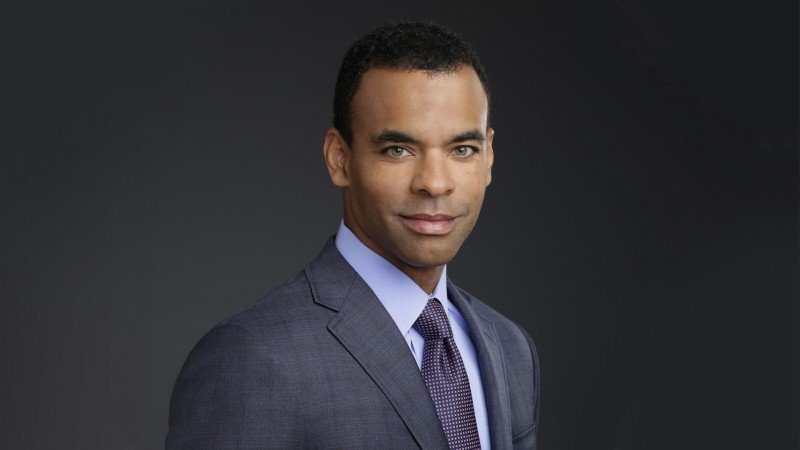

Nearly a month and a half have gone by since Connecticut Gov. Ned Lamont placed the inaugural commercial bet at the Sports Haven retail sportsbook, one of the 15 locations allowed to launch sports bets via Rush Street Interactive's PlaySugarHouse. That followed tribal launch and statewide online rollout earlier in October. To have first-hand insights into this new market in the US, Yogonet spoke with Rob Simmelkjaer, Chair of Connecticut Lottery Corporation’s Board of Directors.

How would you assess this new market so far? What’s the initial feedback and key performance indicators you are looking at today? What’s the situation of those 15 venues today, and what are the next steps there?

We have seen terrific early results since the governor kicked off sports betting in October. All three operators have seen significant growth month-over-month, both online and at retail.

Connecticut Lottery and RSI have now opened nine retail locations around the state. These were all previously operating off-track betting locations operated by Sportech. We are currently in the process of selecting a location in Bridgeport to open early next year and are in discussions with the XL Center Arena in Hartford to open a location in 2022. We also have a request for information in the market for other businesses around the state that would be interested in hosting retail sports betting. We have a specific focus on finding businesses owned by underrepresented groups, including minorities and women. That will be a rolling process that will get us to the full allotment of 15 retail locations by the end of 2022.

In early December, we knew that expanded gambling had generated $1.7 million in revenue for Connecticut since launch, mostly from online casino ($1.2M). Gov. Lamont considered this a “great start” and said it is expected that gambling revenue will generate $100 million a year for the state over the next four or five years. How would you analyze these initial numbers? Do you share those same estimates? Which share do you expect sports betting and iGaming will take in Connecticut’s gaming revenue, at least on the commercial side?

So far the results have been very strong both for the Connecticut Lottery‘s offering and for the market overall. The state recently announced it generated $4 million in tax revenue in November - the first full month of operating both sports betting and online casino games. DraftKings and FanDuel accounted for most of that revenue, which was expected given their brand strength, existing databases, and co-exclusive ability to offer online casino games.

This is just the top of the first inning for the CT online gaming market, which will grow rapidly over the next several years into a significant driver of revenue for our state. The Governor’s estimate of $100 million per year in state revenue seems well within reach.

Why has the CT Lottery chosen Rush Street Interactive and its PlaySugarHouse online sportsbook as its official partner, what added value do they bring? Could you explain and detail how your business model with Sportech works, and how it complements and drives synergies with RSI? Which do you consider as competitive advantages compared to FanDuel and DraftKings offerings at the tribal casinos?

We chose Rush Street Interactive because of the strength of their bid, their track record as a high-quality operator in multiple states, and our belief in their top-notch management team. We believed they would secure market access in New York, which they did, and that was an important factor for us given the fact that southwestern Connecticut is in the New York media market. It’s also important to remember that the statute prohibits Connecticut Lottery from licensing an existing casino brand such as MGM or Caesars, and Play Sugarhouse does not violate that rule.

We believe that the retail footprint of the Connecticut Lottery, both for sports betting and traditional lottery, will be a significant competitive advantage for us going forward. Sports bettors will soon be able to fund their online Play Sugarhouse accounts at our retail sportsbooks. We will also activate our nearly 3,000 lottery retailers to help us acquire new customers. Once we are fully up and running with these initiatives we expect to achieve a significant share of the online sports betting market, and we expect to be the leader in retail. (Note that the tribal casinos do not have to report their retail numbers because they are not taxable by the state.)

We also expect our ability to sell lottery tickets online, which we will launch in 2022, will be a competitive advantage. While the tribal partners’ offerings include online casino games, our online lottery and keno offering will help us attract and retain customers.

Our deal with Sportech was an important element of our ability to get to market quickly at retail, and we now have nine locations open. We are utilizing Sportech’s existing locations and licensed staff from their pre-existing parimutuel operations. They receive a significant share of sports betting gross gaming revenue at their retail locations, a small share of online revenue, and bonus payments for customer acquisition.

For October, Mohegan Sun and Foxwoods reported a significant rise in slot-machine revenue. Do you think the availability of sports betting and online casinos is driving traffic to other verticals you operate? Which are the collateral effects and impacts on your business?

Connecticut Lottery‘s traditional retail lottery sales, which set an all-time record of $1.5 billion in the fiscal year that ended June 30th, are outpacing those record results so far in fiscal 2022. We believe the introduction of online lottery ticket sales in 2022 will spur even more growth. More gaming options for consumers and greater marketing spend in the state seem to be a rising tide that is lifting all boats in the CT gaming industry.

It is also worth pointing out another collateral benefit of the modernization of gaming in our state: the significant revenue being generated by our state’s media industry. The influx of advertising from all three operators on television, radio, digital and outdoor platforms has been significant. This is a welcome source of growth for an industry that is a major employer in Connecticut.

New York is all set to launch mobile sports betting in January, with a 51% gross revenue tax rate, and Massachusetts is still analyzing legislation. What do you think is the impact of Connecticut’s new legal market on neighboring states? Which role is taxation, which in CT is 13.75% for sports betting and 18% for online casino gaming until 2026, will play in this scenario?

I think Governor Lamont and his team got it right when it came to the tax rate for both sports betting and online casino games. We have a tax rate that should allow the development of a healthy market with strong competition among the three licensed entities. The results so far have been impressive.

We are seeing significant online betting activity on our borders with New York and Massachusetts as well as at the retail locations nearest to those states. There is clearly a significant amount of cross-border activity. We expect that will change when New York launches, but we think Connecticut will still offer an attractive alternative to bettors in both of states.

With several states setting new and different kinds of records in terms of sports betting volumes, which place do you think Connecticut will take among the top jurisdictions?

Connecticut is in the top ten states in the country for lottery ticket sales per capita. I think we will see similar performance in sports betting and online casino. We have a well-established gaming history in our state, with the Connecticut Lottery about to celebrate its 50th anniversary next year and the tribal casinos in operation since the early 1990s. We also have tremendous passion for sports in the state, with all the Boston and New York professional teams having significant fan bases. So, I believe Connecticut will be an impressive driver of sports betting revenue for a state its size, and the three operators which have been licensed here should all see very strong results for many years to come.

What are the CT Lottery Board’s plans, goals, outlooks regarding this expanded market for 2022; and where will your focus be as the Chairman? What do you see as the new challenges for next year, and how do you plan to address them?

2021 was truly a landmark year for gaming in Connecticut and the CT Lottery. Having legalized and launched sports betting and online gaming this year, our goals in 2022 will be threefold:

- To fully operationalize the integration between our retail footprint and our online sports betting product, allowing us to grow market share both online and at retail. This includes having all 15 of our retail sportsbooks up and running by the start of the 2022 NFL season.

- To launch an iLottery product that is integrated with our online sports betting platform.

- To continue the strong performance of our traditional Lottery business while celebrating Connecticut Lottery’s 50th anniversary.