Penn National's Q4 revenue and interactive above expectations; share repurchase program cleared

Penn National Gaming released Thursday its report on financial results for the three months and year ended December 31, 2021. In Q4, revenues amounted to $1.6 billion, an increase of $545.1 million in a year-over-year comparison; and $231.3 million compared to 2019. This result was above Wall Street forecasts. The gambling operator re-initiated full-year guidance, with 2022 revenue in the range of $6.07 billion to $6.39 billion.

In 2021 fourth quarter, net income was reported at $44.8 million, and net income margin of 2.8%, as compared to net income of $12.7 million and net income margin of 1.2% in the prior year; and net loss of $92.9 million, and net loss margin of 6.9% in 2019. Adjusted EBITDAR amounted to $480.5 million, an increase of $115.1 million, year-over-year and $81.1 million compared to 2019.

Jay Snowden, President and Chief Executive Officer spoke about the company’s numbers and said: “I am pleased to report a strong finish to another transformative year for Penn National. Our fourth quarter revenues of $1.6 billion and Adjusted EBITDAR of $480.5 million exceeded both 2020 and 2019 levels as our best-in-class operating teams continue to deliver impressive results despite the ongoing pandemic”.

“In addition, we accomplished several strategic objectives this quarter that have laid the foundation for future growth, including the completion of our acquisition of Score Media and Gaming Inc. (theScore), the continued expansion of Penn Interactive operations, the opening of our fourth casino in Pennsylvania and the roll-out of new technology at many of our casinos. Given our confidence and improved visibility regarding both our retail and interactive segments, as well as our strong financial position, we are pleased to announce that our Board of Directors has authorized a $750 million, three-year share repurchase program, and we are re-initiating guidance. For 2022, we are guiding to a net revenue range of $6.07 billion to $6.39 billion and an Adjusted EBITDAR range of $1.85 billion to $1.95 billion,” Snowden said.

Share Repurchase Authorization took place on February 1, 2022. The program matures on January 31, 2025, and, according to Snowden "reflects our confidence in our long-term prospects, and enables us to make both opportunistic share repurchases and offset dilution from stock-based compensation and other equity grants".

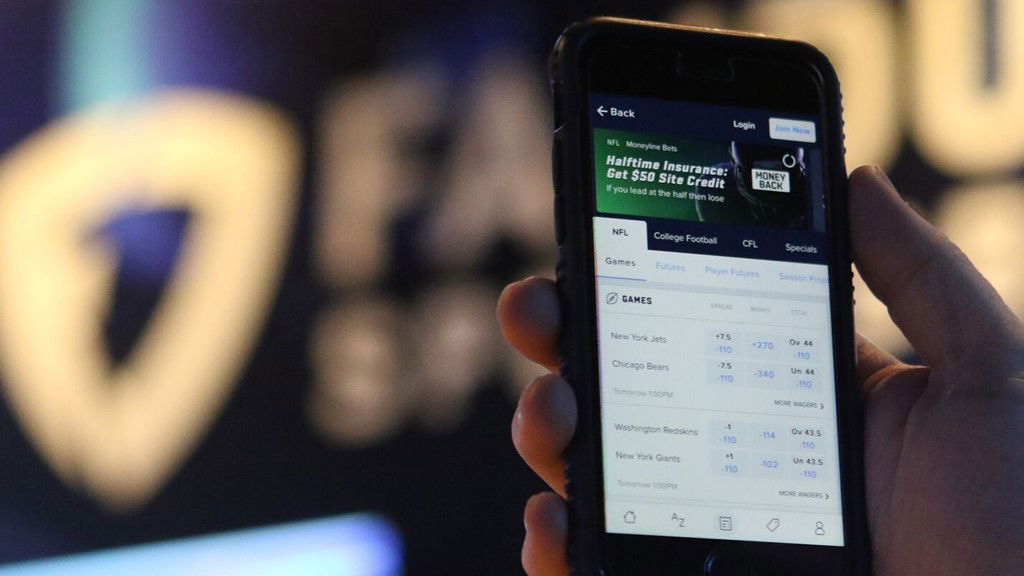

As Snowden reflected, Penn Interactive’s marketing approach and increased scale sets the company apart from the competition “as we generated lower-than expected EBIDTA loss in our Interactive segment in the fourth quarter, despite launching sports betting operations in two states”, the CEO referred to Iowa and West Virginia, as well as the integration of theScore.

The company’s CEO also pointed out that the results were achieved “despite a frenzied competitive environment”, as the company currently operates sports betting in 12 states and iCasino in four, and looks forward to gaining additional scale in 2022 with anticipated launches in Ontario, Ohio and Maryland.

“For 2022, we expect the segment to generate lower losses than our previous outlook; we now anticipate an EBITDA loss of approximately $50 million within our Interactive segment this year as we continue to scale our operations and infrastructure in anticipation of bringing our technology in-house and launching in new jurisdictions. Looking ahead, our differentiated sports betting strategy, along with the integration of the Barstool Sportsbook into theScore media app in the U.S. and continued improvements within our iCasino offerings will enable us to generate meaningful EBITDA in 2023 within the Interactive segment especially as we transition to our wholly owned tech stack,” said Snowden.

The company’s retail operations benefited from expanded reach and new demographics. On December 22, Penn National celebrated the opening of Hollywood Casino Morgantown, its fourth casino in the Commonwealth of Pennsylvania, and 44th property in North America.

Penn National’s investment in technology is digitally transforming its retail operations and enhancing the customer experience, as well as improving its marketing capabilities through its “mychoice” app, which allows the company to communicate with its customers more efficiently.

“We remain encouraged by the ongoing visitation from younger demographics and are focused on reimagining our properties and offerings to enhance the entertainment appeal to this steadily growing segment of consumers”.

In November, the company launched live sports betting at temporary locations in its five Louisiana properties while it built out its Barstool Sportsbook concept at its Lake Charles, Baton Rouge and Bossier City properties.

Barstool’s mobile app saw a sizable growth in the fourth quarter while maintaining a disciplined approach to marketing spend. “We saw increased traction across the board during football season and quickly became one of the leading operators in the crowded New Jersey market despite launching years after most of our peers”.

The recent launches of temporary sportsbooks at Penn National’s Louisiana properties led to a combined market share of 58% in handle and 53% in gross gaming revenues in December 2021; and the company estimates that its total national share of the retail sports betting market outside of Nevada is approximately 12%.

As theScore became one of the first mobile gaming operators to secure certification from Gaming Laboratories International for the launch of theScore Bet sports betting and iGaming app in the province of Ontario, the prerequisite to being operations in the area is already covered. “We expect this market will be a sizable opportunity for us given the strong brand awareness and audience reach of theScore and Barstool Sports”. Snowden anticipated theScore Bet will migrate to its own proprietary trading platform in Ontario in Q3, 2022, pending regulatory approvals, while Barstool Sportsbook app is expected to complete migration in Q3, 2023.