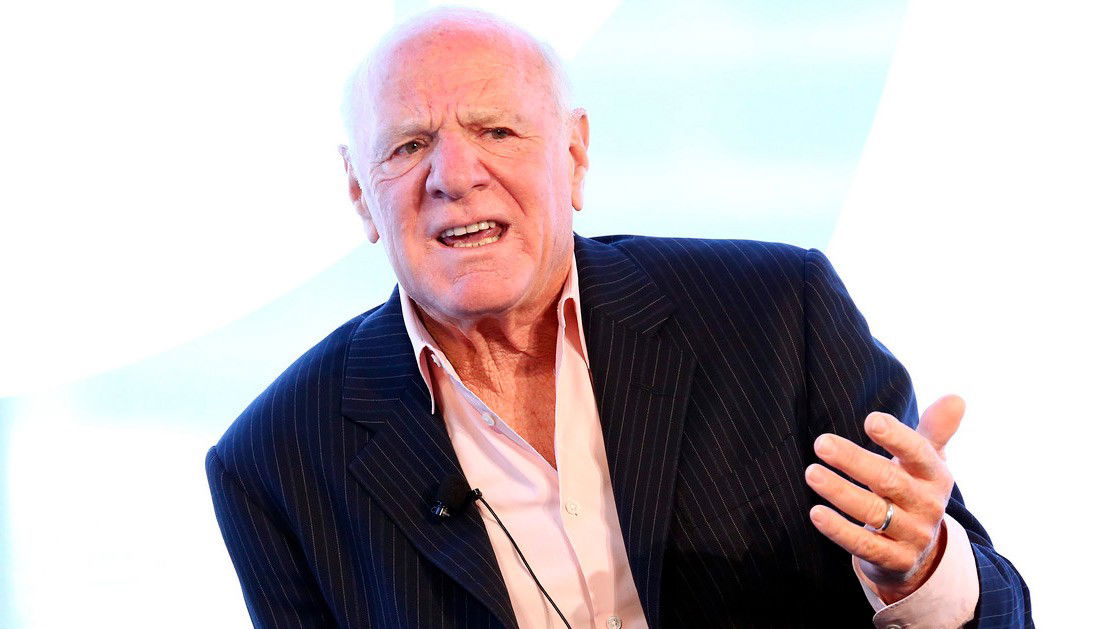

Nevada delays largest MGM shareholder Barry Diller's gaming license application amid federal probe

Nevada regulators are delaying a gaming license for media mogul Barry Diller -Chairman and Senior Executive of holding company IAC —largest shareholder of MGM Resorts International— amid a federal investigation involving stock purchases. The Nevada Gaming Commission has now put the licensing approval on hold and the application has been sent back to the Nevada Gaming Control Board for “investigation.”

News of a federal authorities probe was reported by Wall Street Journal earlier this month. Federal prosecutors and securities regulators are investigating alleged "large bets" that Diller, along with entertainment industry mogul David Geffen, made on Activision Blizzard Inc. shares in January, days before the videogame company agreed to be acquired by Microsoft.

The news of the investigation broke a week after the Gaming Control Board recommended licensing approval on March 2 for Diller and IAC, which controls 14% of Las Vegas-based gaming giant MGM Resorts International, reports The Nevada Independent.

Jennifer Togliatti, Gaming Commission Chairwoman, cited gaming regulations related to the suitability of a license applicant as the reason for referring the Diller and IAC application back to the Control Board staff. She claimed it would be best to have the Control Board investigate the matter separately instead of having the Gaming Commission ask questions to Diller.

“We have steps to this process to ensure that regulators each step of the way have, to the best of our ability, all the relevant information related to suitability,” Togliatti told Nevada Current. “If something comes up for any particular applicant between the time of the board meeting and the commission meeting, our process should not be to gather information in the first instance at the commission meeting.” She further described referral to the GCB as “procedural.”

“Mr. Diller’s license application was not rejected; the matter was simply delayed. We expect no issues with respect to Mr. Diller’s application nor IAC’s,” an IAC rep told Deadline in an email response.

The IAC has a 14% stake in MGM Resorts after an initial $1 billion investment made in August 2020: both Diller and IAC CEO Joey Levin are part of the board. Diller, who is listed No. 206 on the Forbes 400, has grown his stake from an initial 12%, as well as his influence in the company.

Applications, which include both Diller’s and Levin’s, might be put off until an April board meeting. Prominent casino shareholders and executives must be licensed to operate in Nevada’s gambling industry, with the Gaming Control Board tasked with investigating backgrounds.

Wall Street Journal’s report found Diller and Geffen, along with Alexander von Furstenberg -son of fashion designer Diane von Furstenberg- made a $60 million profit after buying shares in Activision Blizzard. The IAC Chairman denied he had any nonpublic information about the deal with Microsoft, describing the stock purchase as a “lucky bet” and a “coincidence.”

Diller, von Furstenberg and Geffen bought options to purchase Activision shares at $40 each on January 14 in privately arranged transactions through JPMorgan Chase & Co., people familiar with the matter told Wall Street Journal. Activision shares were trading around $63 at the time, meaning the options were already profitable to exercise.

The Justice Department is now investigating whether any of the options trades violated insider-trading laws, while the Securities and Exchange Commission is separately conducting a civil insider-trading investigation, the people said. Diller confirmed in an interview they had been contacted by regulators.

The Control Board hearing in Las Vegas about Diller, Levin and IAC was “relatively routine,” The Nevada Independent further reports. Levin told the control board that MGM Resorts offered a “transformational omnichannel experience” and was the first IAC stock acquisition done with the intent of helping another company grow. The IAC CEO further said the company’s commitment to MGM Resorts is long-term.

“We believe MGM presented a ‘once in a decade’ opportunity for IAC to own a meaningful piece of a preeminent brand in a large category with great potential to move online,” Diller wrote in an August 2020 shareholder letter.