Rivalry sees record triple-digit growth in 2021; economic user acquisition costs keep positive trend in 2022

Sports betting and entertainment company Rivalry has announced record fourth quarter and year-end 2021 results. The Toronto-based business posted a betting handle of CAD $78.2 million ($60.9 million) for the full year, increased 202% year-over-year, and a betting handle of CAD $24.9 million ($19.4 million), up 389% YoY.

The momentum is being fueled by economic customer acquisition costs and robust payback periods, the business said. The company posted revenue of CAD $11.1 million ($8.6 million) for the year, up 617% YoY, and Q4 revenue of $2.2 million ($1.7 million), up 615%. It has also unveiled $35.5 million ($27.7 million) of cash and zero debt at year-end, set to support continued growth in core and new markets.

“We had a tremendous year by nearly all measures in 2021. Our team delivered triple-digit growth, secured the financial resources to accelerate our momentum, continued to strengthen our originally developed product, added significant talent depth to our bench, and further solidified Rivalry as the most engaged brand in esports betting globally,” said Steven Salz, Co-Founder and CEO of Rivalry.

The executive further said the pacing has now continued into 2022, with preliminary Q1 betting handle delivering 62% sequential growth over Q4, and up 273% year-over-year. The handle is CAD $40.2 million ($31.3 million), a record high for the company.

We reported Q4/21, FY 21, and prelim Q1/22 at $RVLY this AM. Triple digit YoY growth across the board, with rev of $11.1M for FY 21, up 617% YoY. Growth has continued into 22, with prelim Q1 handle of $40.2M, up 62% sequentially from Q4/21, and 273% YoY. https://t.co/Gi5Qho6dLN

— Steven Salz (@StevenSalz) April 27, 2022

Last year was a landmark one for the business, which commenced trading on the TSX Venture Exchange and the Frankfurt Stock Exchange in October 2021, followed by a listing on the OTCQX just after year-end. But also importantly, the business is encouraged by its growth and the increasing popularity of its products, which it believes positions Rivalry for future success.

“The growth we saw in Q4 was highly encouraging, and a signal of strength in what is typically the most seasonally quiet quarter of the year, with us delivering modest sequential growth over Q3,” added Salz. “As our traditional sports betting product has continued to improve, we are seeing a more diverse product mix, which is helping to blunt the seasonality of esports, something that we expect to continue in the future.”

Operational highlights find Rivalry maintaining a good position in the growing esports segment: about 90% of betting handle is placed on this space, compared to 10% on traditional sports. This is related to the company’s strategy to engage with what it calls “the next generation bettor,” with the average customer age at 26, and 82% of lifetime customers under the age of 30.

Customer registrations for the year were also up to approximately 610,000 by the end of 2021, considerably up from 350,000 one year earlier. Rivalry’s partner network and owned properties reached a total of 55 million followers, another achievement for the company’s carefully-planned social media strategy.

In addition to continuing betting handle momentum into Q1, the new year has also found the company receiving a sports bookmaker license in Australia, which allows Rivalry to legally operate throughout the country. This was subsequently followed by a launch in Ontario on April 4, the first day of regulated online gaming in the province.

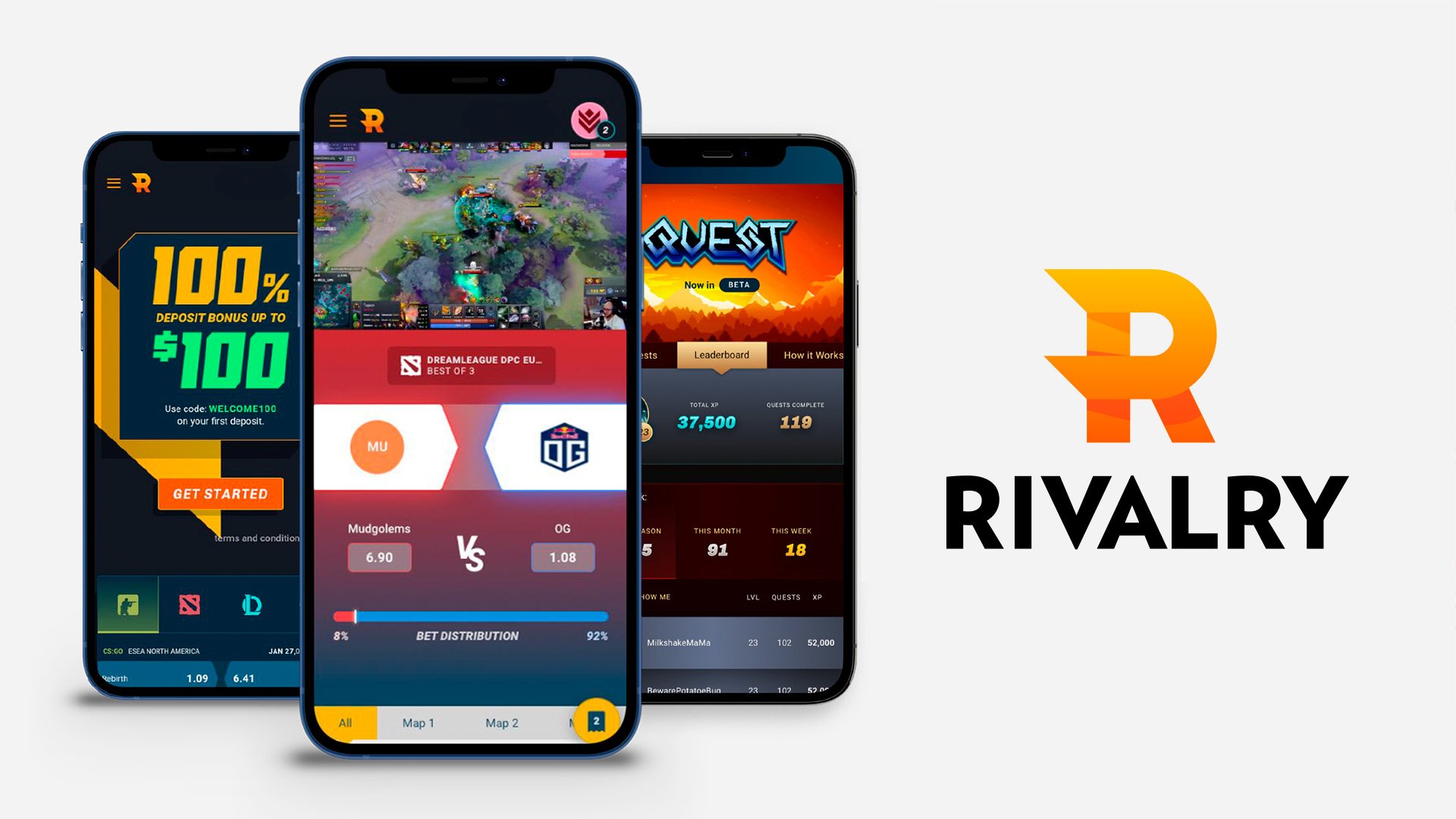

In March this year, the company announced it would be adding mobile esports to its sportsbook, enabling customers to wager on competitive esports played on mobile devices, a rapidly growing segment. But Rivalry also lists as a goal for 2022 to “meaningfully expand” its traditional sports offering in order to support a “continued interest” it is seeing.

Still, competitive online gaming seems to be the main objective. Rivalry intends to produce new originally developed games to complement Rushlane, a proprietary title launched last year, which the company says is pioneering a new gaming category: Massively Multiplayer Online Gambling Games (MMOGG’s).

There are more things to look forward to: there’s the planned launch of a mobile app “consistent with the surprise and delight” Rivalry believes the next generation of customers are looking for, and a new casino offering that is “authentic to the company’s demographic.”

In terms of market expansion, Rivalry plans a launch in new geographies under its existing Isle of Man license, and expects new regulated licenses to provide continuous growth in users and brand reach across the globe. As expected, Rivalry will keep working on its “dynamic media strategy,” with the aim to keep positioning the younger audiences-oriented business “at the forefront of internet culture.”

“Our focus in 2022 is growth across product, new geographies, and an expansion of Rivalry’s creative universe to capitalize on what we believe is a generational opportunity to become the leader in betting and entertainment for the next generation. Through financially disciplined management, and executing on our targeted operational goals, we believe our positive unit economics will improve, and a path to profitability will become clear,” concluded Salz.