India Govt. seeks to raise online gaming tax from 18% to 28%

A Group of Ministers (GoM) tasked by the Goods and Services Tax Council in India has recommended raising the goods and services tax (GST) on online gaming from 18% to 28%. The GoM, headed by Meghalaya chief minister Conrad Sangma, discussed on Wednesday the valuation of services provided by casinos and online gaming.

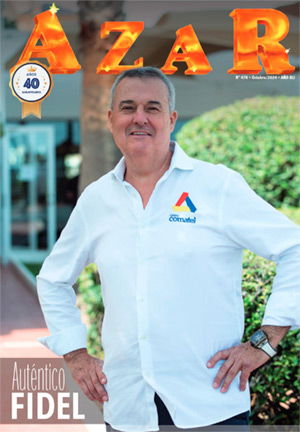

Conrad Sangma, Meghalaya Chief Minister and head of the GoM.

The GoM had earlier met on May 2 and while there was a broad consensus on a flat 28% tax rate, there was no consensus on what should it be levied on — gross gaming revenue or on the basis of per transaction. As reported by Economic Times, a final recommendation report on the matter is expected to be submitted within the week to be discussed in the next GST council meeting.

Currently, online gaming not involving betting or gambling is taxed at 18% of the platform fee, while chance gaming such as racing, betting, and lotteries are taxed at 28% of the contest entry amount.

The Group of Ministers (GoM) on casinos, race courses & online gaming has come to a consensus.

— Conrad Sangma (@SangmaConrad) May 18, 2022

The report of our submissions will be handed over to Hon’ble FM, Smti. @nsitharaman Ji in a day or two & the matter will be presented in the next @GST_Council Meeting @FinMinIndia pic.twitter.com/n3Zm0yHSbl

The gaming industry has been urging the government to keep the online gaming tax rate at 18%, stating that a high GST rate would make the entire online gaming industry unviable. However, the GoM on taxation of casinos, racecourses, and online gaming seeks to bring the skill game tax rate on a par with chance games.

The parity in taxation of online gaming and chance gaming may require amendments to the GST laws, analysts say as reported by Financial Express.

Industry body IndiaTech.org has recommended that only gross gaming revenue (GGR or platform fee) alone should continue to be considered as the value of supply, as per current practice. Additionally, if there are other formats/revenue models followed by platforms such as subscription fees, in-game revenue, etc, GST should be applicable. “It is pertinent to note that the technology platform owner has no right, title, or interest over the prize pool amount,” said Rameesh Kailasam, CEO, IndiaTech.Org.

"IndiatTech.org has recommended that games involving predominance of skill should ideally be taxed at 18% on the platform fee as applicable for entry HS Code 998439 as other online content not elsewhere classified (NEC). Higher tax rates will adversely impact the growth of the industry. Leading global regulated markets including the UK, most countries in the EU and Nevada, and New Jersey in the US, tax GGR at the rate of 15% to 20%. In the year 2000, the UK moved from a 6.5% tax on stakes to a 15% tax on GGR, creating over the next 18 years the largest and most sustainable gaming market in the world," Kailasam said.