US gaming industry posts second best-ever month in April at almost $5B despite macroeconomic headwinds

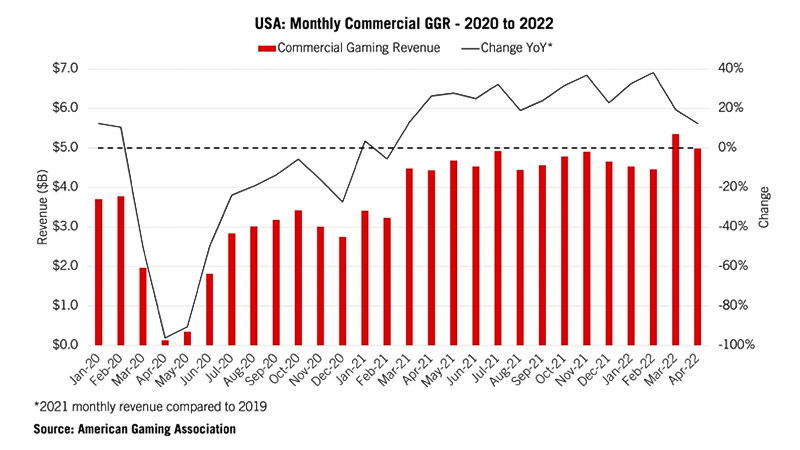

The commercial US gaming industry saw its best month of April ever and the second highest-grossing month of all time in April 2022, according to the American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker. The month was only behind March 2022 for best-ever, meaning momentum in US gaming is still ongoing.

During the month, the industry hit $4.99 billion in revenue, up 12.4% year-over-year despite widespread macroeconomic concerns. The impressive figure was shy of March’s record performance of $5.31 billion. Throughout the first four months of 2022, commercial gaming revenue stands at $19.33 billion, 24.2% ahead of the same period last year.

Gaming revenue grew across every vertical in April year-over-year, AGA says. Traditional casino generated revenue of $4.07 billion, up 5.7% versus April 2021; while sports betting generated $497.5 million in revenue, a notable 74.6% gain over the comparable period last year. iGaming generated $416.4 million, up 38.8%.

Other highlights of the month show that 24 of 31 commercial gaming states that were operational one year ago have now posted year-over-year revenue growth in April. This comes despite a series of headwinds -including supply chain disruptions, labor shortages and rising inflation rates- affecting the gaming industry.

The year-over-year pace of revenue growth began to slow down in April, as comparisons move beyond 2021 months in which the industry was operating with significant COVID-related operating restrictions; and on a sequential basis, gaming revenue dropped 6.8% from March’s all-time highest. Despite this, AGA says that the gaming industry’s growth rate at the start of 2022 “has the potential to be another record-setting year.”

Through April, nearly all commercial gaming states are tracking well ahead of where they were at this point in 2021, the report further shows. Bucking that growth trend is the D.C. sports betting market (-32%), as well as Kansas (-0.3%), Mississippi (-1.2%) and South Dakota (-1.6%).

Additionally, increasingly difficult year-over-year comparisons were “felt heavily” in legacy casino markets Mississippi and South Dakota. This, AGA says, reflects the strength of the consumer gaming market in spring 2021, as operating restrictions were lifted.

Another disappointing figure points out that casino visitation levels were down year-over-year in April in four of the five states that report admission data (Illinois, Iowa, Louisiana, Mississippi, Missouri). Mississippi casinos posted the largest decline (-12.9%) while Illinois casinos welcomed the highest number of visitors -806,302- since before the pandemic. Compared to pre-COVID levels, visitation was down in April an average of 12.3% across the five states.

However, Las Vegas was able to outperform the regional markets as visitation jumped 31.4% year-over-year. Visitation numbers were merely down 4.5% from April 2019, according to a report by the Las Vegas Convention and Visitors Authority.

AGA’s update also breaks down gaming figures by vertical. In April, combined gaming revenue from land-based slot machines and table games grew in 20 of 25 states compared to 2021, while year-to-date revenue from traditional casino gaming is slightly down in only three markets: Kansas (-0.3%), Mississippi (-1.3%) and South Dakota (-2.1%).

On a nationwide basis, traditional casino games generated revenues of $4.07 billion, primarily driven by slots. Revenue from slot gaming was up by 2.2% to $2.95 billion, while table games generated revenue of $786.7 million, notably 26.3% up from the same month last year.

The American Gaming Association remarks that both sports betting and iGaming revenue grew by double-digit percentages in April. Land-based and online commercial sportsbooks generated $497.5 million in revenue from operations in 25 states, excluding Arizona, which had not yet reported sports betting data at the time of publication.

Meanwhile, iGaming in Connecticut, Delaware, Michigan, New Jersey, Pennsylvania and West Virginia generated $416.4 million in April, $6 million short of March’s record revenue. April 2022 had six iGaming markets compared to five in 2021 (excluding Nevada online poker).

Taken together, revenue from iGaming and online sports betting reached $913.9 million, or 18.3% of all commercial gaming revenue in April. This figure shows a decrease from 19.2% in the record-setting month of March, according to AGA’s state-by-state and nationwide insights into the U.S. commercial gaming industry.