AGA calls on US Govt. to partner with the gaming industry on its efforts to deploy a new digital assets strategy

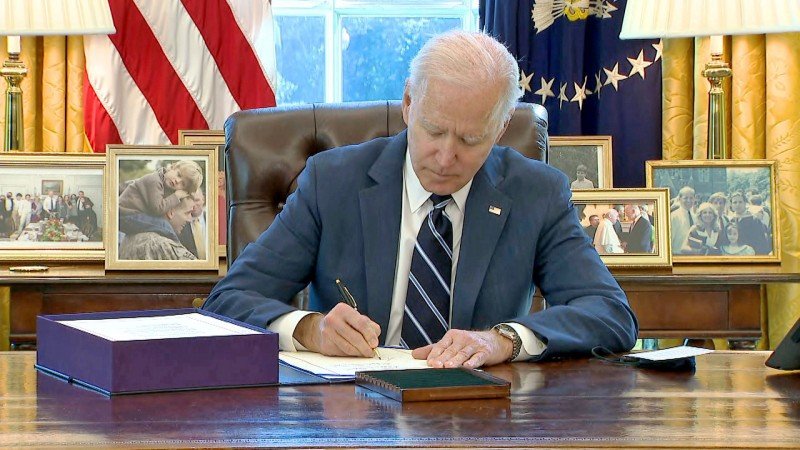

The American Gaming Association (AGA) on Monday issued a letter requesting that the U.S. government under the Joe Biden administration assess how any new frameworks or requirements brought about by the recent Digital Assets Executive Order would map onto the gaming industry, and partner with the gaming industry on the government’s ongoing efforts to develop and implement a digital assets strategy.

The AGA made this call as the U.S. government starts working to translate the policy goals included in the March 2022 Executive Order issued by Biden into actionable legislative and regulatory requirements. This process calls for a “whole-of-government effort” to promote the appropriate principles, standards, and best practices for governing digital assets, such as cryptocurrencies and NFTs.

In the letter signed by AGA's CEO and President Bill Miller, he explains that while gaming companies do not have a uniform view about the role that digital assets should play in the industry, several companies in the gaming industry are considering incorporating digital asset products and/or blockchain technologies into their operations.

"Complying with requirements such as anti-money laundering regulations for fiat currency has illustrated over time that the operations of the gaming industry raise unique questions that can necessitate tailored requirements and guidance for the industry. As they have with fiat currency, AGA’s members remain a willing partner to assist the U.S. government to fashion predictable and workable guidelines to govern the use of digital assets in the gaming industry," he adds.

Miller further notes that the Executive Order acknowledges that digital assets pose risks, including data protection, privacy, investment risk, cybersecurity, illicit finance, and sanctions evasion.

"The Gaming Industry and Digital Assets AGA’s members strongly support the Administration’s Digital Assets Executive Order. They believe that it takes a clear-eyed approach in recognizing both the opportunities and challenges that digital assets and blockchain technology present. Further, they believe that the 'whole-of-government' strategy espoused by the Digital Assets Executive Order will encourage a comprehensive policy response that accounts for the host of unique questions posed by digital assets and blockchain technology," Miller wrote.

Furthermore, he says that due to pandemic-related precautions and demand signals from customers, many of AGA members have accelerated their integration of digital payments from the hotels and restaurants, to the casino floor. "AGA members are firmly committed to complying with their legal obligations, including those related to detecting and reporting financial crime. Indeed, AGA has been a leading partner in working with agencies such as FinCEN to ensure that the gaming industry has clear and predictable guidance on how to satisfy its BSA obligations. By contrast, illegal gambling websites have increasingly been promoting the use of cryptocurrencies to avoid AML, geolocation, and identity controls required by legal regulated operators," AGA CEO underlines.

And he exemplifies: "In the context of the Bank Secrecy Act, for instance, there are often separate regulations or guidance for entities in the gaming industry to account for the unique nature of its operations. AGA members would also ask that the strategy address illegal cryptocurrency operations and provide law enforcement the tools they need to prosecute the offenders."

🚨 NEW: In our recent letter to the Biden administration, read why gaming’s unique financial compliance needs require industry priorities to be considered as the administration implements the Digital Assets Executive Order: https://t.co/dxHpmzbBOE pic.twitter.com/qbS93ki8ih

— American Gaming Association (@AmericanGaming) August 10, 2022

Late last month, AGA released the third edition of its Best Practices for Anti-Money Laundering (AML) Compliance resource. The updated document has been reviewed and revised by the country’s top compliance professionals, reflecting new laws, technologies and indicators of criminal activity.

“As the methods and sophistication of financial crimes evolve, the gaming industry continues to spearhead efforts to combat money laundering,” said Alex Costello, AGA’s Vice President, Government Relations. “An invaluable resource for our industry, this guide demonstrates gaming’s commitment to protect the U.S. financial system from money laundering and other forms of illicit finance.”