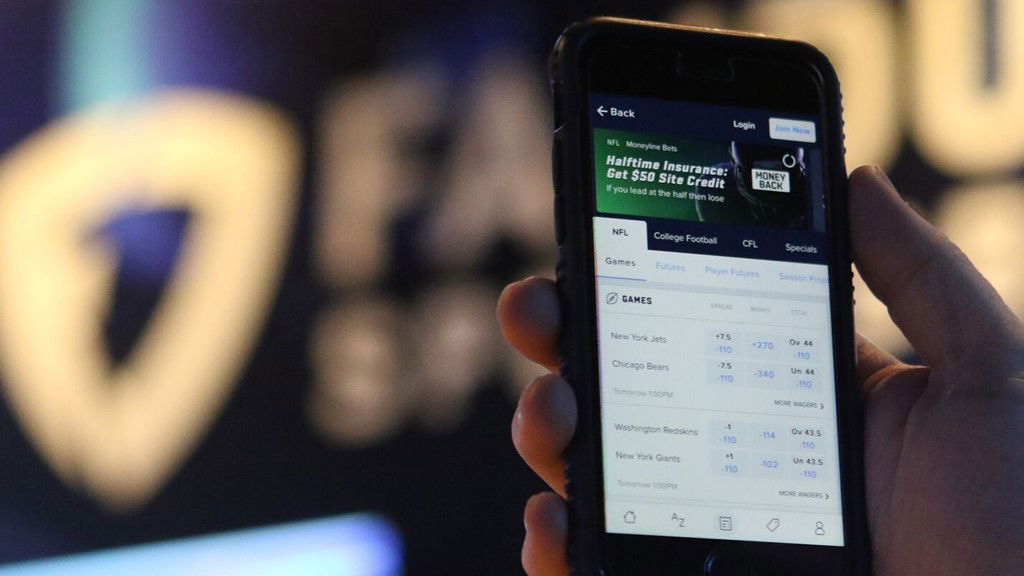

New York court rules in favor of FanDuel in $1B suit filed by founders and early investors

Sports betting giant FanDuel has won its appeal in a New York lawsuit brought by former founders, early investors and employees who claimed they were cheated out of the proceeds of its 2018 merger with Irish bookmaker Flutter Entertainment.

A state appeals court in Manhattan said Thursday that FanDuel shareholders, led by co-founder and first CEO Nigel Eccles, failed to make a valid legal claim against the company under the law of Scotland, where FanDuel is incorporated, reports Bloomberg. The court has ordered the claims to be dismissed. A five-judge panel of the court said that, under Scottish law, directors have fiduciary duties to the company but not to shareholders.

“As to the merits, plaintiffs have failed to state a claim for breach of fiduciary duty under Scots law, as Scots law states that directors generally owe fiduciary duties only to their company, not to its shareholders. While a director may owe a fiduciary duty to a shareholder in special circumstances, such circumstances are not present here,” the ruling says.

Former FanDuel CEO Nigel Eccles

“This is a sweeping victory for our client which confirms that the transaction was fundamentally fair and the proceeds were appropriately distributed,” said Mark Kirsch, a partner with the firm King & Spalding who represents FanDuel and its board of directors, as reported by the cited source.

FanDuel shareholders had claimed that private equity firms including Shamrock Capital Advisors and KKR & Co. had artificially lowered FanDuel’s valuation to keep them from benefiting from the merger with Paddy Power Betfair, which later became Flutter. Eccles and three other founders had also sued over the merger in Scotland in 2018, but later dropped that suit.

FanDuel first offered daily fantasy sports (DFS) in 2009. The complaint said that, in 2017, the company was valued at $1.2 billion as part of a proposed merger with rival heavyweight DraftKings. According to FanDuel shareholders, the company’s board kept the value at a “sham” price below $559 million in order to avoid having to pay them.

The shareholders further claimed FanDuel became immediately more valuable eight days before the board approved the merger, in May 2018, when the US Supreme Court struck down a federal law barring states from allowing sports gambling. According to the complaint, defendants “walked away with shares worth billions and plaintiffs were left with nothing.”

However, FanDuel defended against these accusations, and claimed the lower valuation was due to the company’s poor financial condition at the time of the deal, notes Bloomberg. The case is Eccles v. Shamrock Capital Advisors LLC, 2022-00855, NY State Supreme Court, Appellate Division, First Dep’t.

It remains uncertain if the plaintiffs have grounds for an appeal, or if they will seek another form of litigation. This isn’t the only legal issue FanDuel’s parent Flutter is embroiled in, as the company is still in the midst of arbitration with Fox Corp. in regards to pricing for the media giant’s rights to acquire an 18.6% stake in the gaming operator.

Despite having grown revenue in its latest quarterly reports and having acquired 2.2 million customers since it launched sports betting, FanDuel is still to become a profitable business. However, according to the sports betting brand, figures should lead to profitability by 2023 under the assumption that nine other states launch legal sports wagering.