Gambling in the UK vs Europe

Pavlos Sideris has been involved in the iGaming industry for over 12 years and is director of Double Up Media, a UK-based affiliate lead generation company. Sideris values the importance of fairness and transparency in iGaming and believes in putting players before profit.

Gambling is well-established in most European countries, but the UK is different in several aspects you might not be aware of. In this analysis, Pavlos Sideris, Director at Double Up Media explores some of the differences and similarities.

Popularity and revenue: UK is the biggest gambling market

Gambling is a popular pastime with a steadfast cultural and historical legacy throughout Europe and the UK. Billions of adults gamble across the continent daily, and almost all European countries now allow gambling. According to the European Gaming and Betting Association, 25 of 29 European countries have created competitive markets, while four countries maintain a monopolised system. While we don’t want to get bogged down in stats, it’s always a good place to start and set the scene.

When it comes down to money and market size, gross gaming revenue (GGR) is one of the best indicators we have. For Europe in 2022, GGR stood at €108.5bn. In comparison, the UK generated £14.08bn in gross gambling yield for the same period, making the UK Europe’s biggest gambling market. The second largest is Italy.

Online gambling is a continuously rising trend in the UK and Europe. However, more EU revenue is created by the land-based sector than online. This differs in the UK, where the online industry already accounts for almost half of all GGR (£6.4bn out of a total of £14.8bn). The data shows that European gamblers currently prefer in-person gambling, potentially suggesting that gambling is a more social activity.

As we've seen, in terms of revenue, the UK is the largest gambling market in Europe, despite other countries having larger populations and territories. In 2020, Italy, Germany, France, Spain and the Netherlands were the next largest markets.

Who gambles?

The general patterns of who gambles (primarily men aged 30-44) are similar across the whole of Europe, although, since 2020, there’s been a steadily rising trend in female gamblers. Plus, men start gambling on average at age 20, while women start at age 34.

Overall throughout the UK and Europe alike, men deposit more than women. A 2020 article by Natasha Medvedeva of the company RedLab, states: “In Europe, the average deposit amount for women is around €38.76, whereas men deposit about €54.14”. While women deposit less, they deposit more frequently at an average of 32 deposits, with men at 19. In the UK, men lose £3,709.44 a year to womens’ £2,659.92.

As for gambling activity by country, in 2016 The Economist published that Irish gamblers are the fourth biggest losers in Europe (per adult resident), followed by the UK, Malta and Sweden.

Products: what’s played and where?

There are no EU-wide laws regarding the rules of what gambling products exist in each country or who regulates gambling and how. This means there is a huge variance between what gamblers can and cannot do across Europe.

In the UK, slot machines are the largest revenue-generating product. As you can see below, despite rule and product differences, “casino” products are also the most popular in Europe when measured by revenue share. Plus, across Europe, more players now bet on mobile devices than desktop computers.

The only notable difference in product trends is that in the UK, lottery products account for roughly one-third of GGR, whereas in Europe, it’s one-fifth.

Market setup and attitudes

As there are no EU-wide gambling laws, the market in every European country differs, despite the highlighted similarities between who gambles and what they play. This includes when each country legalised gambling and the government's attitude towards regulating the activity.

The UK has always had a more liberal gambling stance than other European countries, like Norway or Cyprus, which have the strictest gambling laws in the block. For example, aside from two exceptions, the UK is the only European jurisdiction that made way for high-street bookies. It also has more liberal advertising rules (Spain and Italy have an almost complete ban). And in 2005, it was the first to legalise online gambling. It took the following EU countries a further three years to allow online gambling: Italy in 2008, France in 2010, Spain in 2011, and Denmark in 2012. The Netherlands (2021) and Germany (2021-22) are the latest countries to legalise online gambling.

Taxes

Like the laws, the tax rate on gambling revenues across Europe varies. Greece has one of the highest levies at 35%, while the UK has one of the lowest at 21%. Meanwhile, The Netherlands comes in at 29% (+1.5% to the gaming authority), Italy at 22%, and Sweden at 18%.

The tipping point towards overregulation?

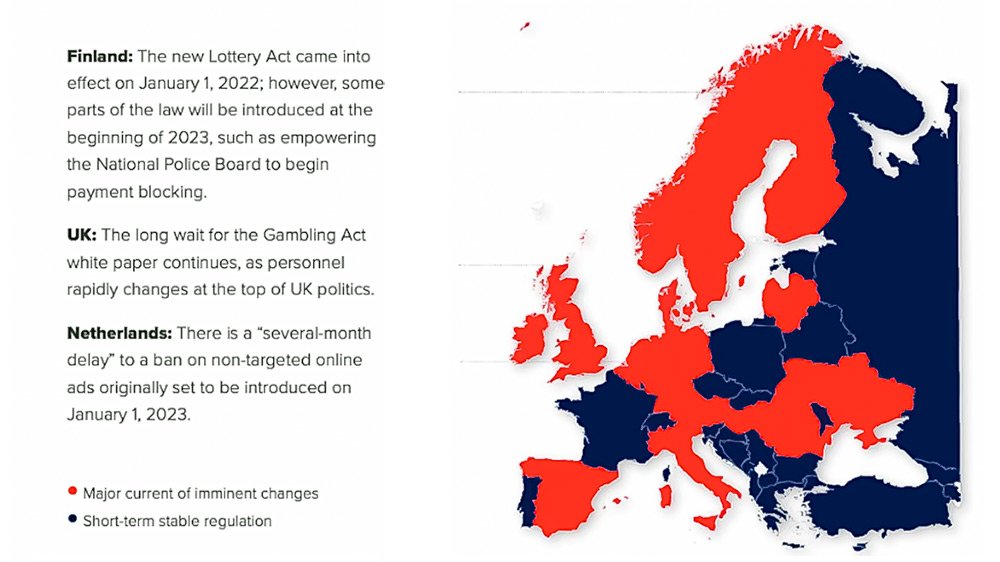

According to Vixio's 2023 Global Gambling Outlook report, European gambling markets are now in the early stages of maturity, but this doesn't mean things are simpler. In contrast, "the reality is that each market does things slightly differently; over time, they only tend to diverge further. Markets such as Germany, Spain, Sweden and the UK are in a state of constant regulatory creep and are rarely in lockstep.”

As more mature markets, most European countries have implemented several rounds of different regulations and collected data sets regarding the success or failure of these regulations as well as gambling participation, problem gambling, revenues, etc. However, data collection methods and standards differ, with some countries using country-wide surveys and others not.

Alongside a research-led approach common across the block, European regulations tend to be tightening. This is also true of the UK, where it has already implemented advertising rules, spin speed and stake limits on slots.

Bonuses and how they are offered have also caught the attention of regulators in recent years following concerns that certain terms and conditions are unfair and force players to keep placing bets in order to release their winnings. In the UK, this has led to the rise of no wagering casinos that offer free spins and other bonuses without restrictions.

The recently released UK whitepaper on gambling reform makes several references to ‘unaffordable spending’ and ‘tougher restrictions on bonuses’, indicating that affordability checks (already present in Norway and the Czech Republic) and new bonus regulations including the restriction of wagering requirements (as in Denmark) are almost certainly on their way.