SAGSE: "Online gaming paved the way for the entry of new players and increased competition in Latin America"

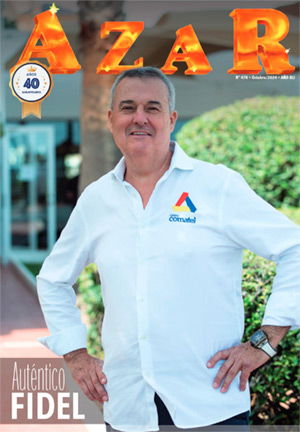

In a recent exclusive interview with Yogonet, Alan Burak, Vice President of Monografie and organizer of the SAGSE gaming show, analyzed the state of the industry in Latin America, its future in the medium term, and highlighted the growth of online gaming operations as an engine for the revitalization of the sector throughout the region.

Event organizers have a key role when analyzing the industry since they maintain close and frequent contact with both gaming operators and regulators, and manufacturers and suppliers, both national and international. Taking into account this knowledge, how do you see the current situation of the gaming sector in Argentina specifically, and in Latin America in general? What fundamental changes can you highlight?

Today, based on 32 years of experience in the region, we can highlight that many Latin American countries (including Argentina) have been reviewing and updating their gaming and betting legislation. Therefore, it is always valuable the existence of events such as SAGSE, in which the opportunities to talk with the main actors of the sector are multiplied.

It is an industry in which we live with constant evolution, and that is where new opportunities are made possible. In some cases, even the result of these exchanges and talks is transformed into new regulations and laws that affect the industry. And to highlight relevant aspects of this moment in Latam, it is worth remembering that the online gaming market has been growing in several countries of the region.

Increased internet penetration, the pandemic, and greater accessibility to mobile devices have led to an increase in online gambling and gaming activities.

In addition, the industry in Latin America has always attracted significant foreign investment, with international operators and suppliers interested in expanding. The region has always been one of the most appetizing and tempting, and online gaming expansion paved the way for the entry of new players, and increased competition in the market.

But, despite the growth, the gaming industry still faces regulatory and compliance challenges. Some countries have been more restrictive on gambling activities, while others have sought to balance economic growth and responsible gambling concerns.

Lastly, it is worth mentioning the impact of the pandemic and post-pandemic. We already forgot about it, but COVID-19 has had a significant impact on the industry, as many casinos and gaming establishments had to close temporarily, due to restrictions imposed to control the spread of the virus. This has led to changes in the way businesses are operated and accelerated the adoption of online gaming platforms.

How has the gambling scenario changed in Latin America, with the advance in online regulation in several jurisdictions, such as Colombia or Argentina, and the imminent opening of sports betting in Brazil and Chile, as well as its regulation in Peru, among other markets?

Several countries in the region, such as Panama, Argentina, and Peru, have made progress in the regulation of online gambling and sports betting in recent years.

Regulation has been an important issue on the political agenda, allowing the creation of clear legal frameworks for operators and players, and increasing security and transparency in the industry.

The markets with the greatest potential, such as Brazil, Mexico, Argentina, Colombia, Venezuela, Chile, and Peru, are identified as attractive for business development and new investments.

Brazil, in particular, is the number one market in the region and is the object of special attention from international and regional investors, operating companies, and suppliers. Specifically, in the case of Brazil, President Lula da Silva signed a bill and a provisional measure (MP) to regulate sports betting. The MP establishes new rules, and becomes effective upon its publication, although the National Congress will have 120 days to analyze it.

This generated a great stir and put the focus on the region. The bill deals with administrative and sanctioning processes, related to sports betting, and in order to become effective, it must go through the legislative process since the beginning.

We believe that the regulation will allow operating companies to apply for a license from the government, which in practice will grant a permit to operate in Brazil for a defined period of time. The value of the license (outorga) will be defined in another regulation from the Executive, and it is estimated that each company will pay about BRL30 million ($6 million) to operate for five years.

With the regulation, a greater collection of public coffers is expected this year, and the mentioned authorization will allow the implementation of gaming houses, the promotion of advertising, and the regular payment of taxes.

The 18% of the GGR is a high number, which is not well seen by the industry, making this opportunity for detailed analysis. Once the income from the operation of games at 18% is obtained, the companies must also pay the prizes to the gambler, after deducting federal and local taxes, and then the liquid collection would be distributed among the Public Security Fund, the Education Fund, the Ministry of Sports, the clubs and operators, among others.

The regulation is expected to result in a collection of between BRL6 billion and BRL12 billion. And it is important to note that such regulation applies specifically to sports betting and not to games of chance, such as bingos and casinos, as these have different definitions and are not included in this provisional measure.

What role does digital transformation play in the region in this whole process of gambling growth?

Digital transformation is a key factor for the growth and penetration of online gambling. We see an increase in financial inclusion, as well as in the use of digital payment methods, cryptocurrencies, and the use of digital wallets. A new generation of digital consumers, aged between 18 and 22, has emerged and shows a consumption and gambling habit focused mainly on the digital channel.

In this regard, sales in the industry are expected to be increasingly concentrated in the online channel, with 85% of sales, leaving the remaining 15% in the retail channel. This is in line with the growing adoption of technology and the shift in consumer behavior towards more convenient and accessible online gaming experiences.

It is important to note that the gaming industry is also paying more attention to responsible gambling and problem gambling prevention. Some countries, such as Colombia and Peru, have established policies to earmark part of the revenues generated from gambling for mental health programs. The importance of addressing this issue to protect gamblers and promote responsible practices in the sector is recognized.

It is important to keep in mind that the situation of the industry in Latin America continues to evolve, and these analyses and projections may change over time. Each country has its own challenges and particularities in terms of regulation and industry development. Therefore, it is essential to keep up to date with reliable information to understand the latest situation in the region.

What would be, in your opinion, the main challenges that Argentina has ahead in terms of gaming, both in sports betting and online gaming as well as in traditional casinos and lotteries, and what role do provincial regulators play in this regard?

The main gambling challenges, both in online betting and in traditional casinos and lotteries, have several points in common.

First is the need for unified and consistent regulation across the country. Currently, gambling regulation varies significantly among provinces, which can generate confusion and inequality in the market. A unified regulatory framework would allow for greater clarity and transparency for both operators and players, as well as fair competition between the different regions.

In addition, both markets require an effective fight against illegal gambling. The proliferation of illegal gambling remains a challenge for the authorities, as it not only represents a loss of revenue for the State but also raises concerns about player protection and the lack of measures to prevent problem gambling. It is crucial to implement effective strategies to combat and discourage illegal gambling in all its forms.

This goes hand in hand with promoting responsible gambling. Its promotion and the prevention of problem gambling should be a priority for regulators and operators. It is essential to implement policies and programs that foster awareness of responsible gambling, as well as to provide support and assistance to those who may be facing problem gambling.

In addition to being an opportunity, is technological development a new challenge for Argentina?

In addition to being an opportunity, is technological development a new challenge for Argentina?

Yes. With the increase in online gaming, it is important to guarantee the security of players' data and protect them from possible fraud and scams. The incorporation of adequate technology and cyber security measures is fundamental to providing a safe and reliable gaming experience.

This goes hand in hand with the concept of transparency and control of the industry. It is essential to ensure that operators comply with established regulations and that there is effective supervision from regulators. Transparency in operations and accountability are fundamental to maintaining the integrity of the gaming industry.

As for the role of provincial regulators, they play a key role. Each province has its own regulatory body in charge of licensing, establishing policies and regulations, and supervising the activities of gaming operators in its territory.

Provincial regulators must work in collaboration with national authorities and agencies to ensure effective coordination and avoid regulatory conflicts. And they should promote best practices in terms of regulation, be attentive to new trends and developments in the industry, and adapt their approaches and policies accordingly.

Collaboration between provincial regulators and industry stakeholders, such as operators, gaming associations, and civil society groups, is also essential to achieve a more effective regulatory framework and to address the common challenges facing the gaming industry in Argentina.

How do you see the investment framework in the country in relation to gaming?

The exchange rate and tariff barriers can have significant effects on a country's industry, and this logically includes Argentina.

A favorable exchange rate can encourage foreign investment in the industry, as international operators may see opportunities to expand their businesses and take advantage of the market with a weaker currency, although the issue of tariff barriers can affect the importation of technology and equipment.

Higher costs due to tariffs could restrict access to advanced technologies, and limit the modernization of gaming services. This slows equipment repurchases, but not the need for equipment, which could change drastically in November, with a new government in the presidential elections.

How is SAGSE planning the second half of 2023, based on the characteristics of the Argentine market, and with what expectations are you already working on the 2024 edition? Will we see many new developments in relation to what we experienced this year at the Hilton Buenos Aires Hotel & Convention Center?

The first thing we have in mind is to call again the Latin public in Las Vegas, through the promotion agreement we developed as an event together with G2E. We want to give the sector a place of preponderance, with VIP options and unique experiences in this city, as we have done in the past, and be their hosts in one of the most important events in the world.

And as for SAGSE, we have great expectations. SAGSE is synonymous with Latam and this time, we will focus on Brazil.

SAGSE is an international trade show, probably the most international in the region in terms of visitors. 75 percent are international executives, and of these, 50 percent come from Brazil.

This means that we will have a lot of Brazilians in the halls of SAGSE again in 2024. Expectations for next year's edition will depend on several factors, but they are all positive, as Latin America is the market that the whole industry is targeting.

It is possible that future editions of SAGSE will present novelties and changes to adapt to the changing demands and needs of the market; and this could include the incorporation of new technologies, the presentation of innovative products and services, and the participation of new industry players, among other possible novelties.