US gaming industry clocks 30 months of consecutive growth, hitting $5.14 billion in August

The U.S. commercial gambling industry continued its long-running expansion in August 2023, with gaming revenue growing by 4.9% on an annual basis. This marks the industry’s 30th consecutive month of year-over-year growth.

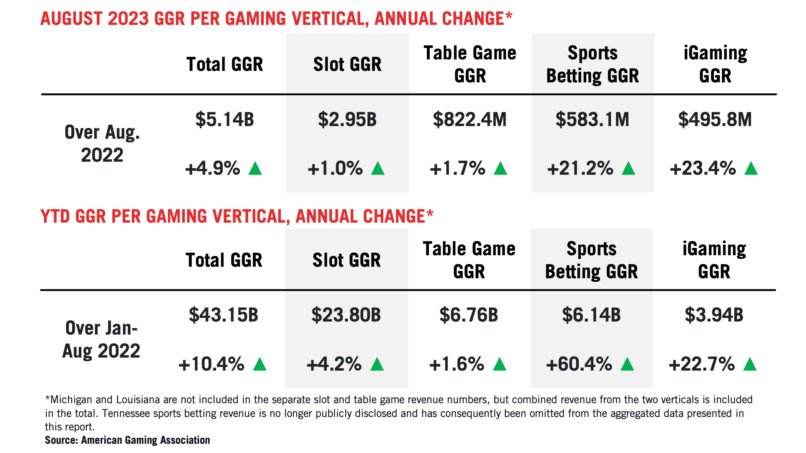

Data from state regulators, compiled by the American Gaming Association (AGA), shows the combined revenue from traditional casino games, sports betting and iGaming exceeded $5 billion for the 12th consecutive month, reaching a total of $5.14 billion.

The results of the first eight months of 2023 indicate that the US gaming industry is on track for a third consecutive record year. Industry revenue is outpacing last year by 10.4%, reaching a cumulative total of $43.15 billion through August.

At the state level, 17 of 33 commercial gaming jurisdictions that were operational a year ago saw gaming revenue growth from August 2022. After the first eight months of 2023, only six jurisdictions remain marginally behind their gaming revenue pace from the same period in 2022: the District of Columbia (-0.7%), Florida (-0.9%), Indiana (-1.2%), Iowa (-0.5%), Missouri (-0.3%) and Mississippi (-3.7%).

Land-based gaming revenue growth has slowed to an average of 1.1% since March, with overall growth being fueled primarily by the ongoing expansion and acceleration of online gaming.

In August, revenue from land-based gaming, encompassing casino slots, table games and retail sports betting, increased by a modest 0.8% year-over-year. Conversely, online gaming revenue surged by 24.6%.

The continued growth of online gaming revenue was largely driven by the introduction of online sports betting in Kansas, Maryland, Massachusetts, and Ohio within the past year, along with consistent growth in iGaming in the six states where it is legal.

In August, traditional casino slot machines and table games collectively generated $4.06 billion in total revenue, a year-over-year increase of 1.1%. Specifically, slot machines contributed $2.95 billion in revenue, marking a 1.0% increase, while table game revenue saw a 1.7% increase, reaching $822.4 million.

Through August, the combined revenue from casino slot machines and table games reached $33.03 billion, surpassing the same period last year by 3.3%. At the state level, 19 out of 26 commercial gaming states offering these gaming options in 2022 posted year-to-date revenue growth in these segments through August.

Though up 36.1% year-over-year, the summer lull in the sports calendar limited monthly sports betting handle nationwide to $6.67 billion. Operators reported $583.1 million in revenue, 21.2% higher than last August, driven by expansions into four new states and the introduction of online sports betting in Maryland since last year. Excluding these new markets, sports betting revenue was up 1.7% compared to August 2022.

Through August, commercial sports betting revenue stands at $6.14 billion, up 60.4% on the same period last year. Meanwhile, the year-to-date handle is $68.23 billion, 21.6% ahead of 2022. Assuming no significant slowdown in the growth rate between now and December, the annual sports betting handle is poised to surpass $100 billion this year.

In August, the combined revenue from iGaming operations in Connecticut, Delaware, Michigan, New Jersey, Pennsylvania and West Virginia saw an impressive 23.4% year-over-year increase, reaching $495.8 million. Every legal iGaming market, except for Delaware, reported annual growth.

Year-to-date iGaming revenue reached $3.94 billion, a robust 22.7% increase compared to the same period in 2022.