Rivalry revenue climbs 34% to $26.2M in 2023, driven by expansion into new segments

Canadian sportsbook and iGaming operator Rivalry announced unaudited financial results for the three and 12-month periods ended December 31, 2023. Rivalry said the expansion into new segments helped drive revenue up by 34% year-on-year to CAD 35.7 million ($26.2 million) in 2023, while the betting operator was also able to reduce net loss by 22%. The strong preliminary figures came despite a somewhat mixed performance in Q4 when revenue fell 32% to CAD 6.5 million ($4.7 million).

In 2023, the betting handle amounted to CAD 423.2 million ($311.2 million), an increase of 82% from CAD232.8 million ($171.2 million) in 2022. According to the report, gross profit was lower in Q4, dropping 40%; however, for the full year, gross profit was up by 66% to CAD 16.2 million ($11.9 million).

During Q4, net loss was cut from CAD 12.3 million ($9.05 million) to CAD 9 million ($6.6 million), while for the full year, net loss was CAD 24.3 million ($17.8 million), a reduction of 22% from the net loss of CAD 31.1 million ($22.8 million) in 2022.

Total operating expenses of CAD 38.9 million ($28.6 million) in 2023 decreased by CAD 1 million ($735,402) year-over-year. This was driven by a reduction in marketing expenses, offsetting increases in general and administration and technology and content expenses incurred to support the growth of the business.

"Rivalry exited 2023 as an increasingly diversified company – both geographically and across our product suite," said Steven Salz, Co-Founder and CEO of Rivalry. "Last year we gained meaningful traction in new segments such as traditional sports, casino, and fantasy, which is widening our opportunity set and positioning us for sustainable growth in the medium- to long-term."

"We're happy to have finished the year with all-time high customer economics, diversified revenue streams, and a reinforced competitive moat around Gen Z betting entertainment and experiences," he added.

According to the CEO, the company's "operational excellence" across product and brand marketing is seen across positive KPI trends and continued year-over-year growth. "Ultimately, we are proving that we can acquire and retain a coveted Gen Z demographic through an entertainment-led product set, culturally relevant brand, and a team unafraid of pushing past a long-standing industry status quo," he explained.

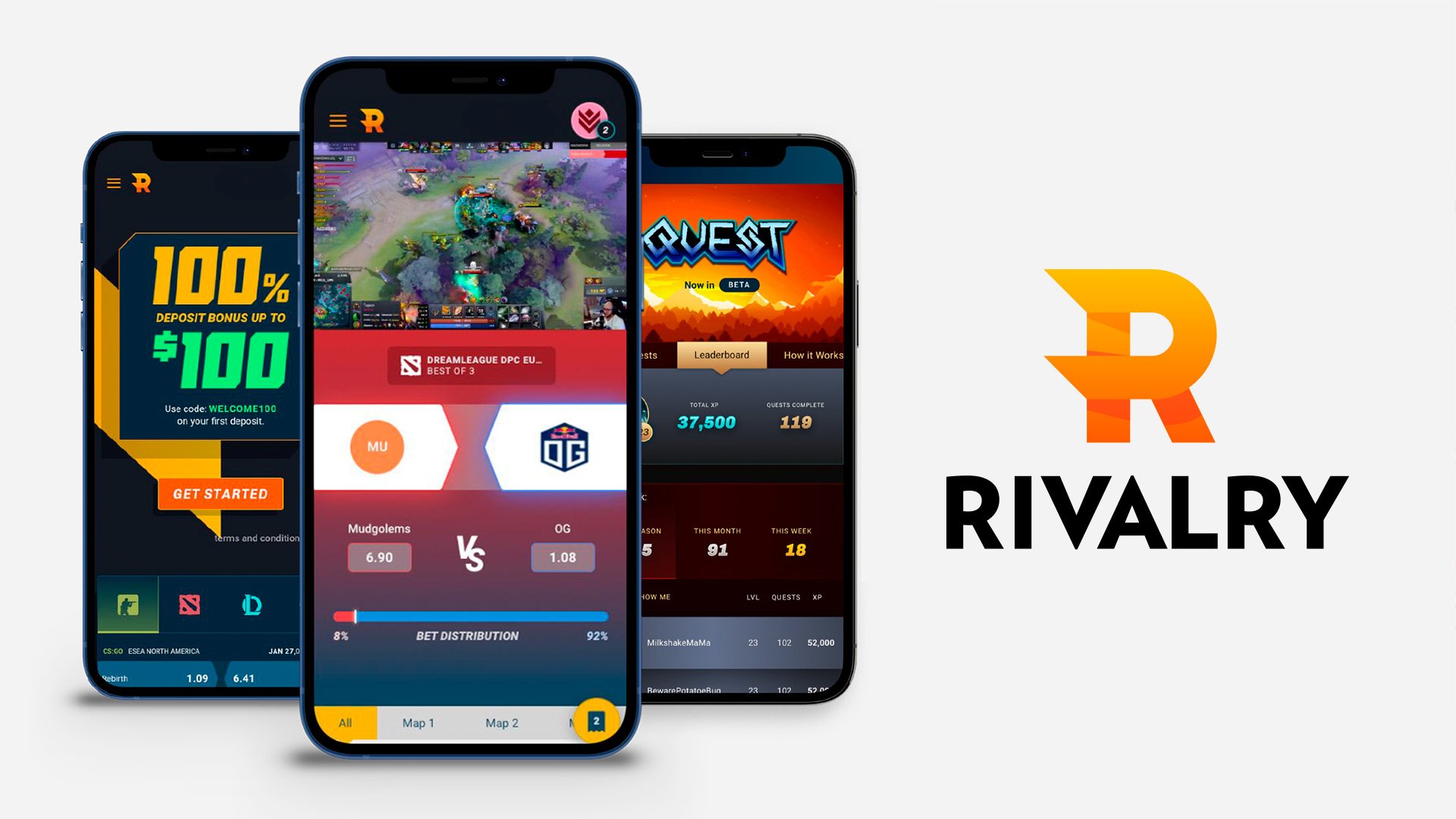

During the year, the company expanded its casino offering significantly, including the release of the original game Cash & Dash in September, entry into the slots category in October, and the launch of its iOS mobile app in Ontario.

Keen to build on its overall success in 2023, Salz detailed Rivalry’s current roadmap. During Q1, he said the operator has been strategically deploying capital from Q4 investment in areas that are driving customer acquisition and revenue. This includes amplifying proven marketing strategies, releasing higher-margin products, and developing proprietary betting experiences. The executive expects this to begin materializing in its results throughout the first half of 2024 and beyond.

With this, Rivalry has reaffirmed guidance and anticipates achieving profitability in H1 2024. "The year ahead is rife with new, innovative product releases arriving in Q2 and continuing throughout 2024," Salz said. "In addition to the strength of our core roadmap, we are in the process of unlocking what we believe to be two of the most material developments to our business model since launching Rivalry in 2018."

"The first is a B2B vertical to license in-house developed games. The second is exploration and development within the crypto ecosystem – each representing an impactful growth catalyst on our path to profitability this year," he added.

Salz further shared that apart from new products, original games, and proprietary features, the company has been working to dial up the overall feel and entertainment value of its core products "to provide a tech-savvy, next-generation customer with a tailored experience that is well-differentiated within the larger sports betting marketplace."