The future of iGaming is here: Atlaslive’s spotlight on South America

Atlaslive, a tech B2B supplier for the iGaming sector, provides in its latest analysis a look into the growth that the online gambling market is expected to have in South America. According to the article below, provided by the company, the region's user numbers are projected to reach 10.4 million by 2028.

As a key region within the LATAM iGaming market, South America offers unparalleled opportunities for building successful ventures. At Atlaslive, we’re committed to empowering iGaming operators with cutting-edge solutions designed to drive success. Our advanced platform and comprehensive suite of tools are tailored to meet both local regulations in South America and international standards, ensuring seamless operations for our partners.

Several factors have propelled the rapid rise of iGaming across South America. The accessibility of online platforms enables users to enjoy games and place bets from the comfort of their homes with minimal effort. The widespread adoption of mobile devices has further boosted this trend, allowing users to engage in gaming and betting anytime, anywhere.

Market dynamics have also played a significant role. The surging popularity of online sports betting has captured the attention of millions, as fans wager on their favorite teams and athletes during major sporting events. Additionally, regulatory advancements in several South American countries have created a safer, more structured environment for online gambling, fostering growth and confidence in the industry.

The region’s online gambling market is set to grow significantly, with user numbers projected to reach 10.4 million by 2028. Leading markets like Argentina, Brazil, Colombia, Guyana, Paraguay, and Peru account for a substantial portion of this revenue. By 2024, user penetration in online gambling is expected to rise to 2.1%, signaling the growing acceptance and enthusiasm for iGaming across the region.

South America is home to diverse cultures, yet its people share a vibrant and energetic spirit. Tech-savvy and fun-loving, they embrace digital entertainment that combines excitement with social connection. iGaming offers a perfect match, providing engaging experiences that can be enjoyed anywhere, anytime.

This dynamic and fast-evolving environment has captured the interest of both players and operators, solidifying South America’s position as a pivotal market in the LATAM iGaming landscape. It’s no surprise that the industry is buzzing with excitement to tap into the immense potential this region has to offer.

Explosive growth: Market success and player preferences

User penetration in South America's online gambling market is projected to reach 2.1% in 2024, signaling ample room for growth as more individuals explore and engage in online gaming activities.

The accompanying graph reveals a steady rise in revenue across the region's online gambling sector, with online sports betting emerging as a major contributor. By 2028, total online gambling revenue is expected to exceed $8 billion, fueled by the rapid expansion of online sports betting, which continues to capture an increasing share of the market.

Sports betting is experiencing remarkable growth, fueled by South America’s deep-rooted passion for football. Online gambling platforms have capitalized on this enthusiasm by providing a wide array of sports betting options, particularly for prominent football leagues and tournaments, which has played a key role in driving market expansion. While sports betting remains the dominant segment, online casinos are steadily gaining traction, attracting a growing number of players.

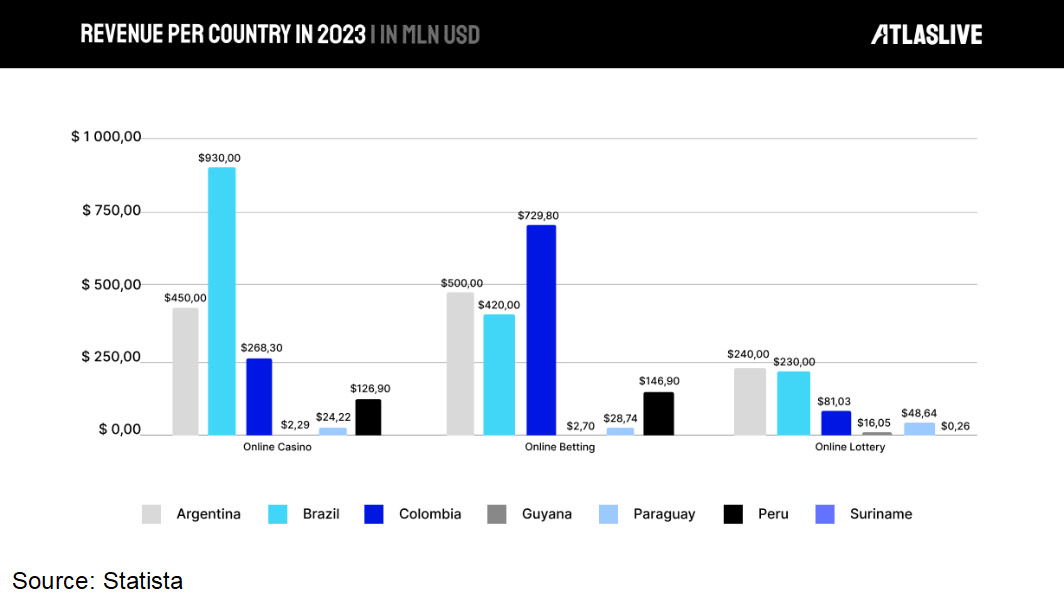

The graph below provides a breakdown of the 2023 revenue distribution across various segments of the online gambling industry in South American countries, highlighting the significant contributions of both online casinos and sports betting to the market’s overall success.

eSports are rapidly gaining traction, particularly in Brazil, where the passion for competitive gaming is undeniable. The 2022 IEM Rio tournament showcased this enthusiasm, with Brazilian teams like FURIA Esports, 00 Nation, and Imperial Esports competing against global powerhouses in front of a packed Jeunesse Arena. The event reached an impressive peak viewership of 1.4 million, reflecting the growing interest in eSports across the nation.

However, despite Brazil’s talented players and devoted fanbase, government recognition of eSports has been limited. Former sports minister Ana Moser classified eSports as entertainment rather than a competitive sport, excluding it from the General Sports Betting Law’s framework. This stance has hindered the development of regulated betting on eSports tournaments. Yet, with shifting perceptions and the market’s undeniable growth, change could be on the horizon, potentially paving the way for betting on these thrilling competitions.

The average revenue per user (ARPU) in South America

The Statista graph highlights notable shifts in the average revenue per user (ARPU) across different online gambling sectors between 2017 and 2028. The online casino sector demonstrates remarkable growth, with ARPU rising from $48.05 in 2017 to an anticipated $556.40 in 2028. Conversely, the online lottery sector shows a steady decline, with ARPU decreasing from $504.80 in 2017 to a projected $285.80 by 2028, reflecting contrasting trends in user engagement and spending across these segments.

Online sports betting is on a consistent upward trajectory, projected to reach $652.10 in ARPU by 2028, overtaking both online casinos and lotteries. This trend underscores the growing preference for sports betting and online casino platforms among users, signaling a shift in market dynamics.

These figures highlight the immense potential of South America's ever-evolving iGaming market. The region offers significant opportunities for investment and growth, driven by increasing demand for cutting-edge technologies and innovative solutions that enhance player experiences. Embracing these advancements will be crucial for engaging the tech-savvy, entertainment-focused South American audience, ensuring sustained growth and success in this dynamic market.

Beyond sports betting why crash games are gaining traction in South America

Crash games are increasingly popular due to their simplicity, fast-paced nature, and the level of control they offer, unlike traditional slots. These games consistently rank among the top choices in the South American market. At Atlaslive, we recognize that a diverse player base requires a wide variety of games to cater to different tastes, which is why we ensure our platform includes a rich assortment of popular titles.

Atlaslive continues to partner with many new globally recognized game providers, and currently, our casino games portfolio is outstanding in terms of variety of games, visual appeal, and diverse bonuses and perks. We already offer more than 15,000 online casino games, live games, virtual sports, lotteries, and tournaments all in one place. We see how many players in South America are engaged in playing crash games, slots, and roulette, and we are doing everything to meet the needs of our partners by providing all the exciting games their customers desire. At the moment Atlaslive Platform includes more than 100 crash games, including all popular ones.

Diverse regulatory frameworks in the South American iGaming market

At Atlaslive, we stay attuned to the ever-evolving regulatory landscapes across South America. Each country presents unique legal requirements and compliance standards, shaping opportunities and challenges for iGaming operators. Understanding and adapting to these nuances is essential for supporting our partners in navigating the region effectively.

Brazil and Colombia

Brazil has made significant strides in its regulatory framework. In December 2023, the legalization of online sports betting and casino games under Bill 3,626/2023 marked a pivotal moment for the industry. As one of Latin America’s largest economies, Brazil’s regulated iGaming market presents immense growth potential. At Atlaslive, we are fully prepared to meet the high demand and stringent compliance standards set by this new legislation, empowering operators to capitalize on this opportunity.

Colombia, on the other hand, stands as a regional leader in gambling regulation. Since 2016, Coljuegos has overseen the industry, prioritizing compliance and responsible gambling. Its well-established regulatory structure provides operators with a stable and secure environment, making Colombia a key market for sustainable growth.

Argentina, Peru, and Chile

Argentina offers a unique regulatory environment with its decentralized approach. Each province governs its gambling regulations, creating a complex mosaic of rules. While this structure poses challenges, it also provides opportunities for operators to tailor their strategies and establish a foothold in diverse provincial markets.

Peru is in the final stages of solidifying its regulatory framework for iGaming. The introduction of new online gambling regulations in 2023 allows MINCETUR to license and oversee the market, implementing a 12% tax on net profits for licensed operators. With user penetration at 2.1%, Peru is showing strong growth in player interest, particularly in casino games. As regulations are finalized, the market is becoming increasingly attractive to operators eager to tap into its potential.

Chile is also making significant progress towards regulating online gaming. Following the lead of countries like Colombia and Argentina, Chile has introduced licensing systems for online gambling. The Ministry of Finance has presented legislation to regulate online casino games and sports betting, with early stages of approval already achieved.

Atlaslive commitment and adaptability to the market needs

Atlaslive Platform continuously develops cutting-edge iGaming Platform to meet the versatile needs of operators across regulated destinations in Latam. From Sportsbook and casino solutions to advanced Payment Hub, Analytics, and CRM tools, we deliver an integrated approach to enhance user experiences while ensuring full compliance with local regulations. By combining innovation and strategic expertise, we support our partners to offer a secure, engaging, and legally compliant gaming environment in this dynamic region.

Atlaslive — the tech behind the game.