Casino Association of New Jersey warns proposed online gaming tax increase would harm AC economy

The Casino Association of New Jersey (CANJ) has voiced strong opposition to Governor Phil Murphy’s proposal to raise the state’s tax rate on online gaming, warning that the measure could have serious consequences for Atlantic City’s casino industry, workforce, and tourism sector.

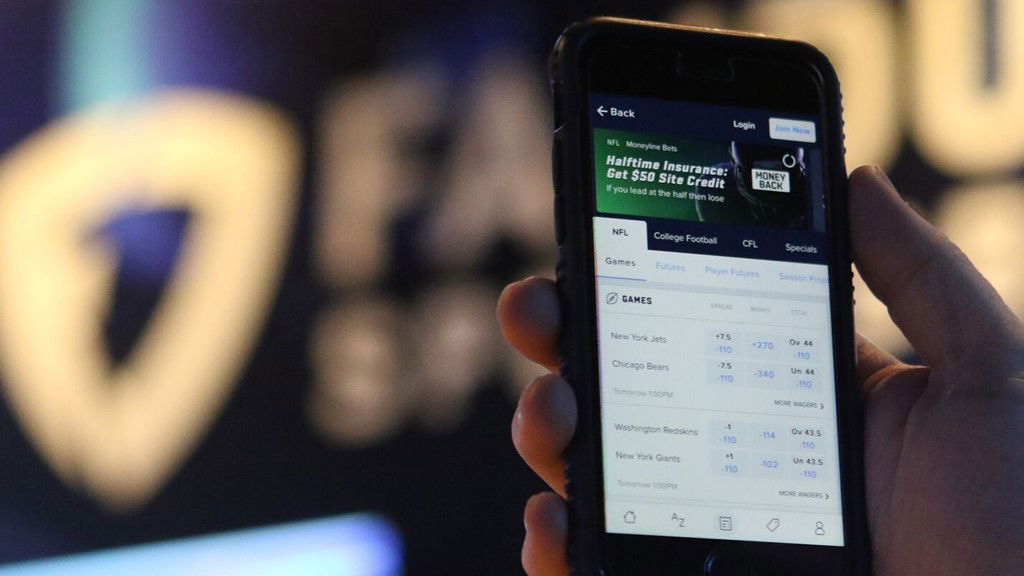

Under the governor’s fiscal year 2026 budget plan, the tax rate on online sports betting and iGaming would increase to 25%, up from the current rates of 13% and 15%, respectively. The state anticipates that the change will generate an additional $402.4 million in revenue, with $322.6 million directed to the Casino Revenue Fund and $80 million allocated to the General Fund through sports betting.

However, CANJ President Mark Giannantonio strongly criticized the proposal, stating that a tax hike would hurt Atlantic City’s casinos, which continue to recover from the impact of the COVID-19 pandemic.

"The Casino Association of New Jersey strongly opposes the proposed tax increase for online gaming, which will threaten the stability of Atlantic City's gaming and tourism industry, as well as the industry's workforce," Giannantonio said.

He argued that the partnerships between online gaming operators and Atlantic City casinos have provided significant financial benefits, allowing reinvestment in brick-and-mortar properties and helping to attract visitors through promotional offerings such as complimentary hotel stays and gaming credits.

He warned that a higher tax rate would limit these reinvestment opportunities, weakening the competitiveness of Atlantic City’s gaming market and leading to a decline in consumer spending.

Giannantonio also cautioned that the tax increase could drive consumers toward unregulated offshore betting sites, which do not contribute to state revenue or provide the same consumer protections as licensed operators.

"This type of tax hike will not yield such expected tax dollars to the State Treasury because it will result in diminishing returns through a consumer shift away from the licensed and regulated providers and back to the unregulated and illegal, offshore online businesses from which the state derives no revenue," he said.

Atlantic City’s casino industry continues to face economic challenges, with six of the city’s nine casinos yet to return to pre-pandemic gaming revenue levels. Giannantonio described the proposal as an unnecessary burden that would jeopardize jobs and hinder efforts to revitalize Atlantic City’s status as a leading beachfront resort destination.

The debate over gaming taxation is not unique to New Jersey. Other states, including Ohio and Maryland, are also considering tax increases on sports betting. Ohio Governor Mike DeWine has proposed doubling the state’s sports betting tax rate from 20% to 40%, while Maryland Governor Wes Moore is seeking to raise the tax on both sports betting and table games to address a $3 billion budget shortfall.

In New Jersey, lawmakers face a June 30 deadline to finalize the fiscal year 2026 budget. While the proposal is expected to face opposition from gaming operators, industry insiders predict that resistance may also emerge within the legislature.