Maryland lawmakers scale back governor’s betting tax proposal

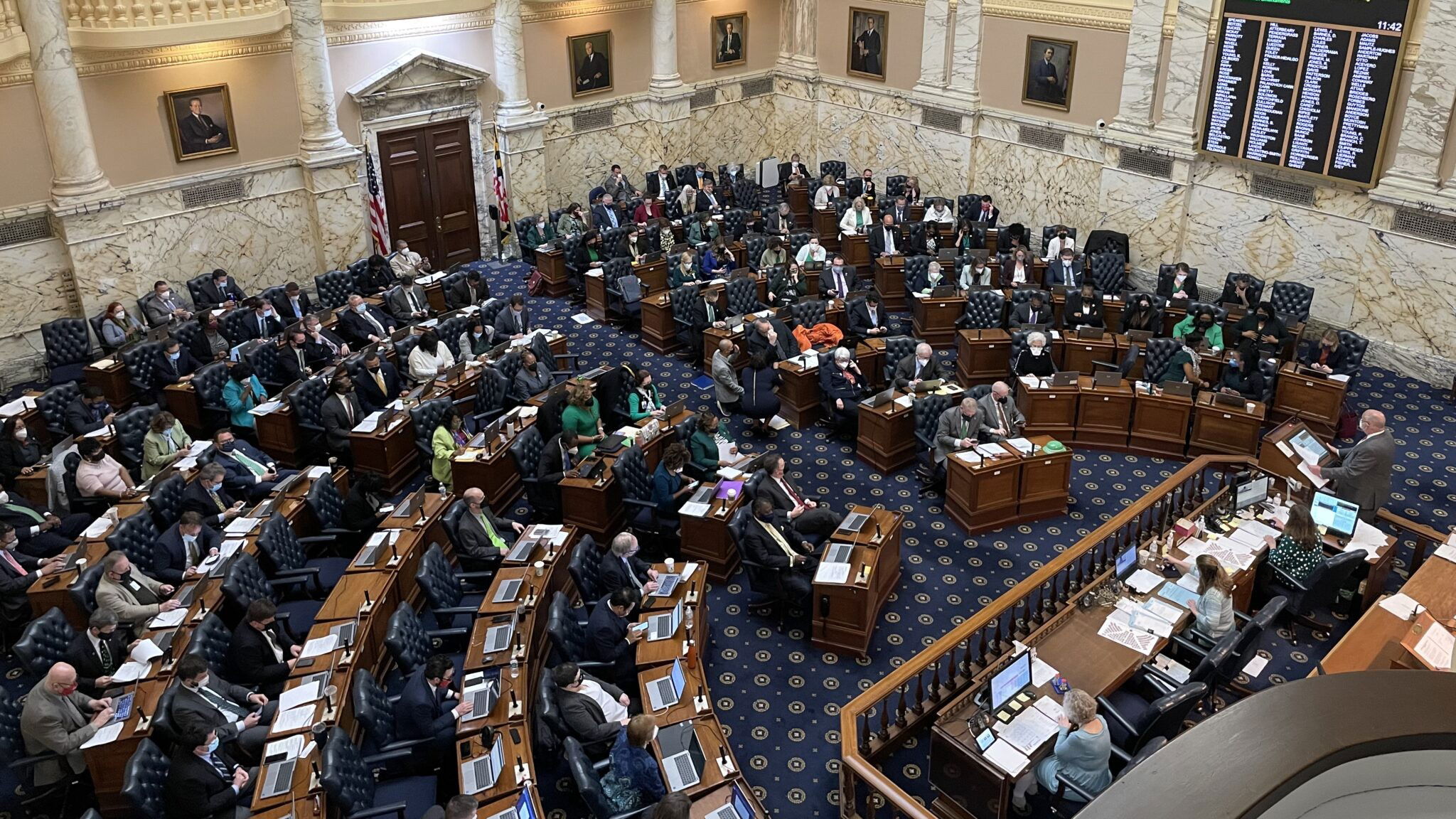

Maryland lawmakers have pushed back against Gov. Wes Moore’s plan to double the state’s online sports betting tax, instead approving a more modest increase to 20% as part of a revised budget proposal.

Moore, a Democrat, had originally proposed raising the tax rate from 15% to 30% to help address a $2.7 billion budget deficit. The revised rate was included in the amended of HB352, titled as Budget Reconciliation and Financing Act of 2025, which cleared the House Ways and Means Committee in a 13-5 vote.

While Moore argued that a 30% rate would align Maryland with neighboring states and generate more revenue, lawmakers opted for a 20% tax rate compromise, which still requires final approval by April 7.

The committee also rejected a separate proposal from Moore to increase the tax on casino table games from 20% to 25%.

If approved, Maryland would become the third state in two years to raise its betting tax rate. The decision comes amid a broader trend of states re-evaluating their sports betting tax policies:

• Ohio raised its tax rate from 10% to 20% in 2023, and Gov. Mike DeWine has proposed another increase to 40%, though it faces resistance in the legislature.

• Illinois implemented a sliding scale tax rate in 2024, with top operators taxed as high as 40%.

• New Jersey Gov. Phil Murphy has proposed increasing the tax on online sports betting and iGaming to 25% from the current 13-15%.

• New York remains the highest-taxed sports betting market in the U.S. at 51%, though some lawmakers have called for a rate cut to encourage more operators to enter the market.

Maryland’s proposed tax increase is expected to generate an additional $32 million in revenue for fiscal year 2026. However, industry stakeholders have raised concerns that higher taxes could make the market less competitive and discourage investment from operators.