Rep. Dina Titus revives push to eliminate federal Sports Betting Tax

Rep. Dina Titus (D-Nev.) has reintroduced legislation to repeal the longstanding federal excise tax on sports betting, reviving a bipartisan effort to remove what she argues is an outdated and unfair financial burden on legal sportsbooks.

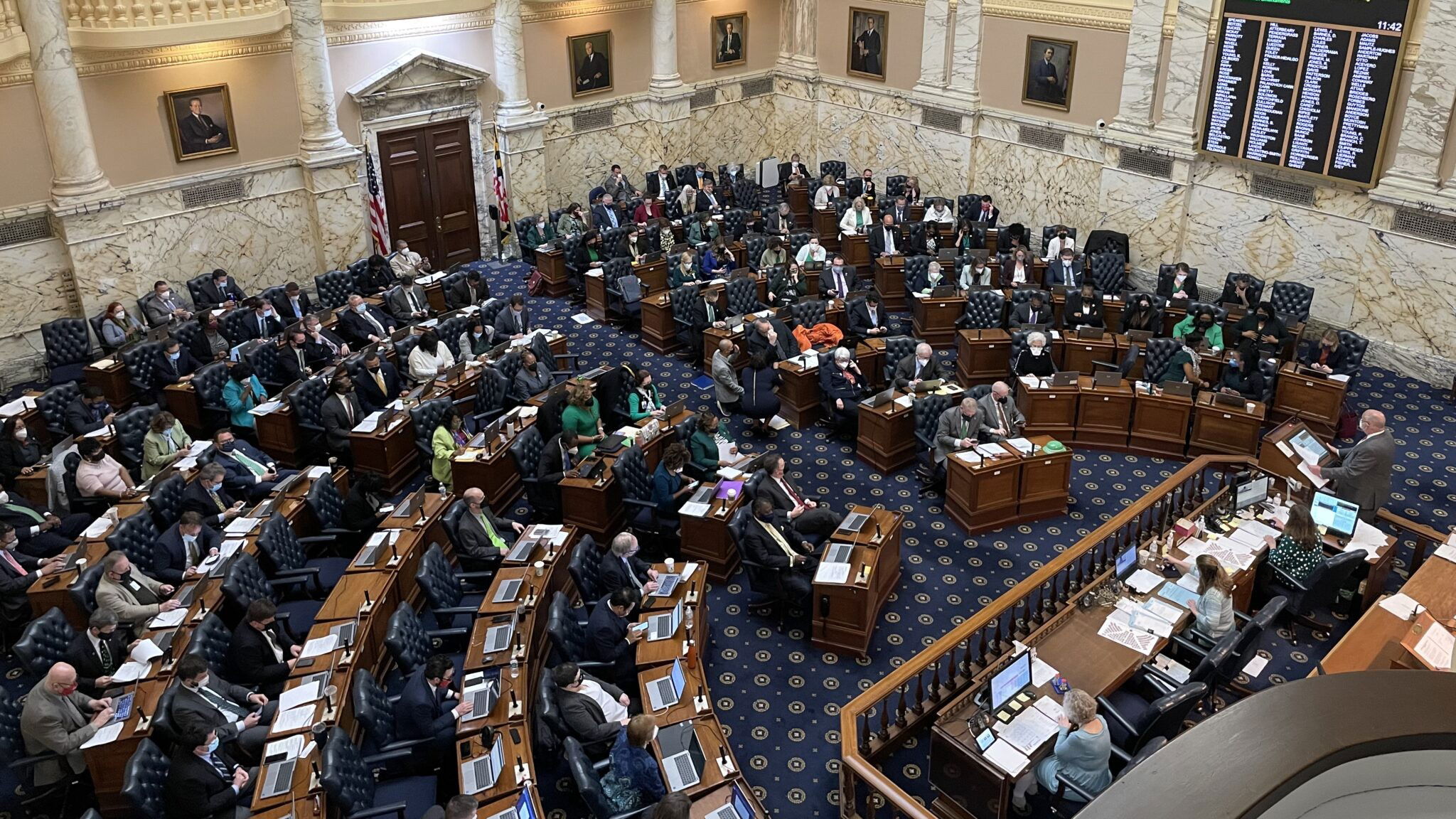

Partnering once again with Rep. Guy Reschenthaler (R-Pa.), Titus refiled the Discriminatory Gaming Tax Repeal Act in the House of Representatives. The legislation targets the 0.25 percent excise tax, commonly referred to as the “handle tax,” which is levied on all legal sports wagers. The bill also seeks to eliminate a $50 annual tax imposed on sportsbook employees.

Titus and her co-sponsors argue that eliminating the federal excise tax would improve the competitiveness of the legal betting market while helping to reduce reliance on illegal bookmakers who pay no federal levies. The proposed legislation has yet to be assigned to a House committee for further consideration.

The excise tax, first enacted in 1951 as a tool to combat illegal gambling, predates the Supreme Court’s 2018 decision that gave states the power to legalize sports betting. Titus contends the tax is now obsolete and penalizes legal operators in the 38 states and Washington D.C. that have regulated betting markets.

“Illegal sportsbooks do not pay the 0.25 percent sports handle tax and the accompanying $50 per head tax on sportsbook employees, giving them an unfair advantage,” Titus said.

“I once asked the IRS where the revenue from the handle tax went in the federal budget and they didn’t even know. It makes no sense to give the illegal market an edge over legal sports books with a tax the federal government does not even track.”

This is the fourth time Titus and Reschenthaler have introduced similar legislation, having made prior attempts in 2019, 2021, and 2023. Despite bipartisan support and growing momentum in the legal sports betting industry, the bill has failed to advance past House committees in previous sessions.

The renewed push comes as sportsbooks across the country experience peak betting activity during the NCAA men’s and women’s basketball tournaments. According to the American Gaming Association (AGA), Americans are projected to wager $3.1 billion on this year’s March Madness, a jump from the $2.7 billion bet during the 2024 tournament.

In 2023, Nevada’s 66 licensed sportsbooks handled $8.26 billion in wagers, generating $481.3 million in revenue and $32.5 million in state gaming tax contributions. Meanwhile, New York led the nation with $19.18 billion in bets placed through 19 licensed operators. Those bets yielded $1.7 billion in gross gaming revenue and $862.6 million in state tax revenue.