"Operators are now seeing the opportunities that reside in other verticals"

Which have been the financial/social/corporate consequences of the coronavirus health crisis?

With live sports events that previously ran into the hundreds of daily events now reduced to just a handful, the whole sportsbook vertical has been affected by the current situation. The lack of live content translates directly to a significant loss in terms of turnover, with many industry experts expecting as much as 70% or even higher in terms of loss.

However, it is the retail operators that faced the major brunt of the whole situation with governments all over the world imposing social distancing measures. Whereas other operators could opt to diversify their revenue stream by integrating new content and expanding alternative and complimentary verticals and cross-selling these expanded verticals to their target players, these retail licensees have had to face the conundrum of diversifying their business setup and diversify to the digital mediums.

Which were the measures/restrictions/limits/changes your company implemented voluntarily or had to adopt in accordance with local policies?

As a company, we were very agile in adapting to the situation from a corporate perspective and ensured the safety of our employees. Being a multi-national company, we already had the right practices and mentality in place ensuring that work could still be carried out without a hiccup from the safety of one’s home, thus observing the various government’s appeals for social distancing. We value highly our employees and will continue to take all the necessary precautions to ensure their safety.

The current situation also meant that we had to take a new approach regarding our technifying tours that we had planned for LatAm and Africa. With a widespread travel ban in place, traveling to different countries in these regions to meet current and potential customers had to be shelved for the time being. Nonetheless, our local experts are conducting their meetings digitally, and thus we have not been impacted from this point of view.

Has this situation changed your company's short- and long-term strategies and business plans?

Whilst the long term strategy of the company remains intact, for the short term we shifted our attention in assisting all our partners throughout this period characterized by a shortfall in the live sports events. Luckily throughout the past months, we have invested a lot of our resources in expanding all the verticals and have not focused solely on providing the best content for the live sports events. This has come in handy for our partners who had the opportunity to diversify their strategy and mitigate for the current lack of live sports events by expanding the content of the other verticals in the least time-to-market.

Nonetheless, even if we are at an advantageous position having developed amongst other things the most in-depth online casino portfolio with over 8000 games from over 100 different providers, we continue working hard to provide our partners with the widest content solutions available on the market. Even from a sportsbook perspective, our trading team has compensated for the lack of live events by adding as new markets including amongst other things live simulated Tennis games based on a vast historical Tennis database, Fifa e-soccer with a selection of pre-match and in-play offers, a wide selection of special bets covering a wide array of topics, extended racing content, and a virtual league that includes the top leagues which have been suspended and an accumulative jackpot based on these matches.

Do you think the tendencies and customer behavior expected for this year and beyond will change in light of the pandemic?

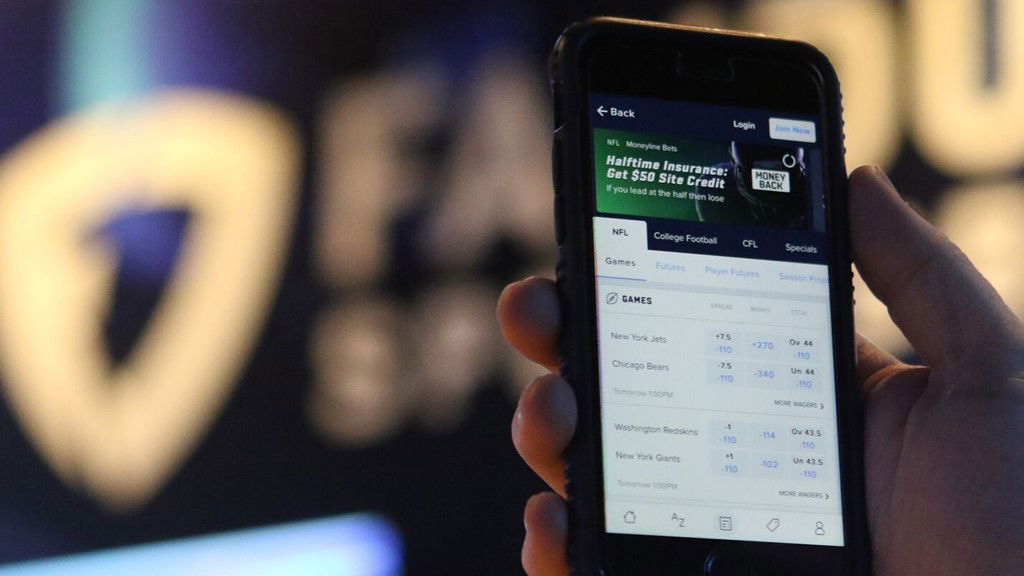

Live sport events are resuming sooner rather than later. And I expect a high player engagement, if not actually higher, once the situation normalizes itself. Does this mean that the industry will resume in its steps before the COVID-19 pandemic ensued? The iGaming industry is a very agile industry and operators will pick up where left. Nonetheless, I also expect the industry to accelerate in its shift from the retail to the online channels, with players increasingly opting to place their bets from their mobile, smartphone, tablets, or laptop. These are set to be the primary point of sales on the medium to long term.

Operators are now seeing the opportunities that reside in other verticals. Since sport events have been canceled, sports betting players have turned their focus to alternative betting products, be they virtual sports, esports, and online casinos amongst other verticals.

In today’s context, I expect this “cross-selling” to other verticals to become even more determining as we go forward, because the current situation will surely have a lasting effect even on people in terms of their gambling behavior.

Retail operators will further seek to diversify their business strategy and move towards the online channels, with BtoBet already registering a strong interest from operators to make use of its technologies and facilitate their process as they move towards the online channels. Does this mean that the brick and mortar experience will be a thing of the past? Certainly not. Retail betting shops and casinos still offer a betting and gambling experience in their own unique way. On the other hand, I do envisage an expansion to the digital channels to complement the retail offer, with operators necessitating of diversification of their revenue stream whilst also being better placed to retain their current fold of players and acquire new customers through targeted marketing campaigns.

The post-COVID-19 situation could also see a shift towards mass regularisation of the online gambling industry, that are still lagging behind in the process. Governments are already gauging how they can weather the economic fallout brought about by the pandemic. The iGaming industry will be seen as a resource not only in terms of tax revenue, but also as a source for job opportnities during these trying times.

How can your company and the industry capitalize on this experience?

I truly believe that the post-COVID-19 situation will eventually result in operators, especially those basing their business model on vast retail networks, seeking to diversify their strategy. Thus those platform providers who are able to provide the right technology for all channels will eventually be at the forefront of the market.

Throughout the years, we have invested heavily in interconnecting all betting channels to create a single betting experience that is totally independent of place, and the medium used. This work is evident in our Neuron 3 platform, which takes an in-depth consideration of the retail approach, allowing operators to target their non-registered customers at the retail level and transform them into registered players and thus have their betting experience extended to the digital mediums.