Two years after PASPA's repeal, US sports betting legislation expected to speed up

Two years after a decision by the United States Supreme Court paved the way for each state to legalize different forms of sports betting, the market has exceeded many stakeholders' expectations and changed the relationship between sports leagues and the gambling industry.

Over $20 billion has been bet since the Supreme Court struck down the Professional and Amateur Sports Protection Act (PASPA) of 1992 on May 14, 2018, which had restricted regulated sports betting to primarily Nevada for 26 years, before being ruled unconstitutional.

All stakeholders will be playing close attention to state legislatures that may accelerate sports betting initiatives to generate new revenue to help mitigate losses caused by the pandemic. On Wednesday, the New Jersey Division of Gaming Enforcement reported $2.6 million in sports betting revenue in April, an 87.6% decrease from April 2019.

"When legislatures return in earnest, we firmly believe the number of states ready to consider accelerating mobile sports betting and online gaming legislation to drive tax revenue will expand substantially," Matt King, CEO of FanDuel, told ESPN. "And we also see the industry recognizing this is a unique moment in time, and working more collaboratively to set aside minor differences and get bills across the finish line. Across the board, it's a time for pragmatism, and we see that producing a real opportunity for significantly expanding the map."

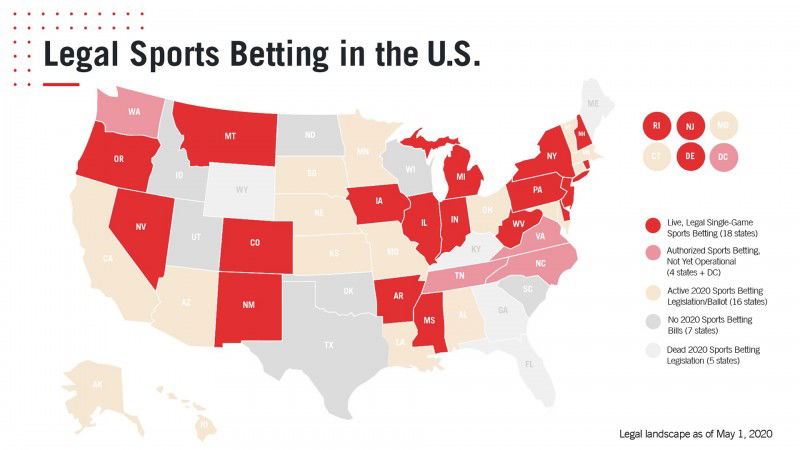

Eighteen states, representing just over 30% of the U.S. population, now have regulated sports betting markets, with several more on deck. The District of Columbia, North Carolina, Tennessee, Washington and Virginia have passed legislation, and 16 additional states have active sports betting bills, according to the American Gaming Association (AGA). In the coming years, industry authorities expect more than half the states in the U.S. to offer legal sports betting.

Twelve states have approved full-scale online sports betting, including in Tennessee and Virginia, which will offer online wagering only. Of the $4.6 billion bet with New Jersey sportsbooks in 2019, nearly 84% of it was placed online.

FanDuel and DraftKings, two companies who made their mark in daily fantasy sports, are now full-fledged bookmakers and online casino operators, who have earned significant shares of the New Jersey market, well ahead of more traditional gambling companies like MGM Resorts and Caesars Entertainment.

In terms of responsible gambling amid this market growth, problem gambling experts are concerned that states are not considering the potential harm caused by addiction. An analysis by the National Council on Problem Gambling (NCPG) showed nine states that recently authorized sports betting did not dedicate any new funding to problem gambling services.

"Research indicates that anytime we introduce a new form of gambling we will simultaneously bring additional problems and concerns, thus requiring additional dollars," Brianne Doura, legislative director for the NCPG, told ESPN. "It is our stance that all stakeholders bear the responsibility to contribute to the research, prevention, treatment, and recovery of gambling addiction. If you profit from legalized gambling, you share the responsibility to pay for the negative consequences that can come from it."

As new stakeholders in the gambling industry, the NFL, Major League Baseball and the PGA Tour are members of the NCPG, as well as the NBA's Portland Trail Blazers. The leagues have quickly pivoted from their long-held objection to sports betting and are now actively participating in the industry, with sponsorship and marketing partnerships with gambling operators.

"I don't know if this is a specific trigger, but I would say that trajectory, even pre-COVID, had shown a level of willingness [from the sports leagues] to engage and at least understand what the industry is all about," said Matt Primeaux, president of sportsbook operator FOX Bet. "I would expect that to continue."

Fox, Barstool Sports and the Score are among the media companies that have or will soon launch branded sportsbooks. ESPN has a sports betting-focused partnership with Caesars Entertainment, and CBS Sports has partnered with sportsbook operator William Hill U.S.