DraftKings plans to expand into new markets, "one day be like an Amazon"

DraftKings has ambitions to keep expanding, including plans to offer a wider variety of products and services.

“We certainly have ambitions to one day be like an Amazon, who started selling books and now look at them,” CEO Jason Robins said in an interview with FOX Business’ Varney&Co on Tueday. “Ultimately we want to have a whole series of products.”

Statements come after DraftKings’ recent acquisition of Golden Nugget Online Gaming in a $1.56 billion deal. It is an all-stock transaction deal that will bring synergies of $300 million, cross-sell opportunities, and loyalty integrations. It is also expected to expand DraftKings’ iGaming accounts with more than 5 million customers.

Moreover, it will bring a tech-driven product expansion including Live Dealer offerings and cost optimization via migrating Golden Nugget’s current technology to DraftKings’ in-house proprietary platform; as well as market access on favorable terms via Golden Nugget casinos and a new sportsbook at the Toyota Center.

“We have ambitions to be a very multi-product base company well beyond online gaming,” Robins further added in the interview, and said DraftKings is in search of products that overlap with the existing customer demographics.

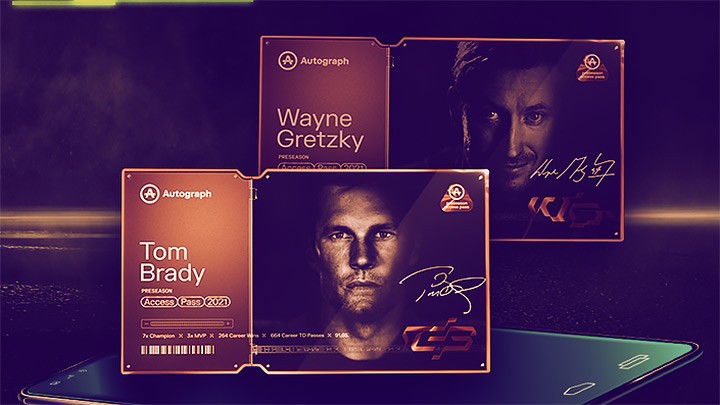

But the Golden Nugget acquisition is not the only recent expansion plan carried out by the company. In other news, DraftKings launched on August 10 a new NFT marketplace that allows its users to buy and sell non-fungible tokens of sports stars.

This new step shows the company’s willingness to expand into new markets, the NFT one being a relatively new and niche one. So far, the marketplace has gone live in cooperation with Tom Brady’s Autograph platform, allowing fans the opportunity to acquire certified authentic content of the athlete.

“I think we’re early and it’s a huge number for a market this early. Who knows where the ceiling is,” Robins said in regards to recent figures in the NFT market, which reached $2.5 billion in sales in the second quarter.

"I also think it will be great for us from a customer acquisition standpoint to have all these different athletes that are out there with their names and hopefully supporting and engaging their fans," described to Varney&Co.

These deals have turned the fantasy sports giant into other new areas, including sportsbook and casino operators in recent years. In Q2 2021, the company reported revenue of $298 million, above Wall Street analysts’ expectations. The expansion of their OSB and iGaming product offerings into new states and the return of traditional sports were key factors in the positive results, which CEO Robins believes will allow the company to expand into new areas and grow userbase.

“DraftKings had a particularly strong second quarter of 2021, maintaining our impressive financial performance while also advancing into new areas, such as media and NFTs. We believe these expansion opportunities will enable us to further grow our customer base and generate additional revenues through cross-selling to our existing players,” said upon presenting the company’s quarterly report.