STS net profit soars by over 56%, closes H1 with $69.2 million in revenue

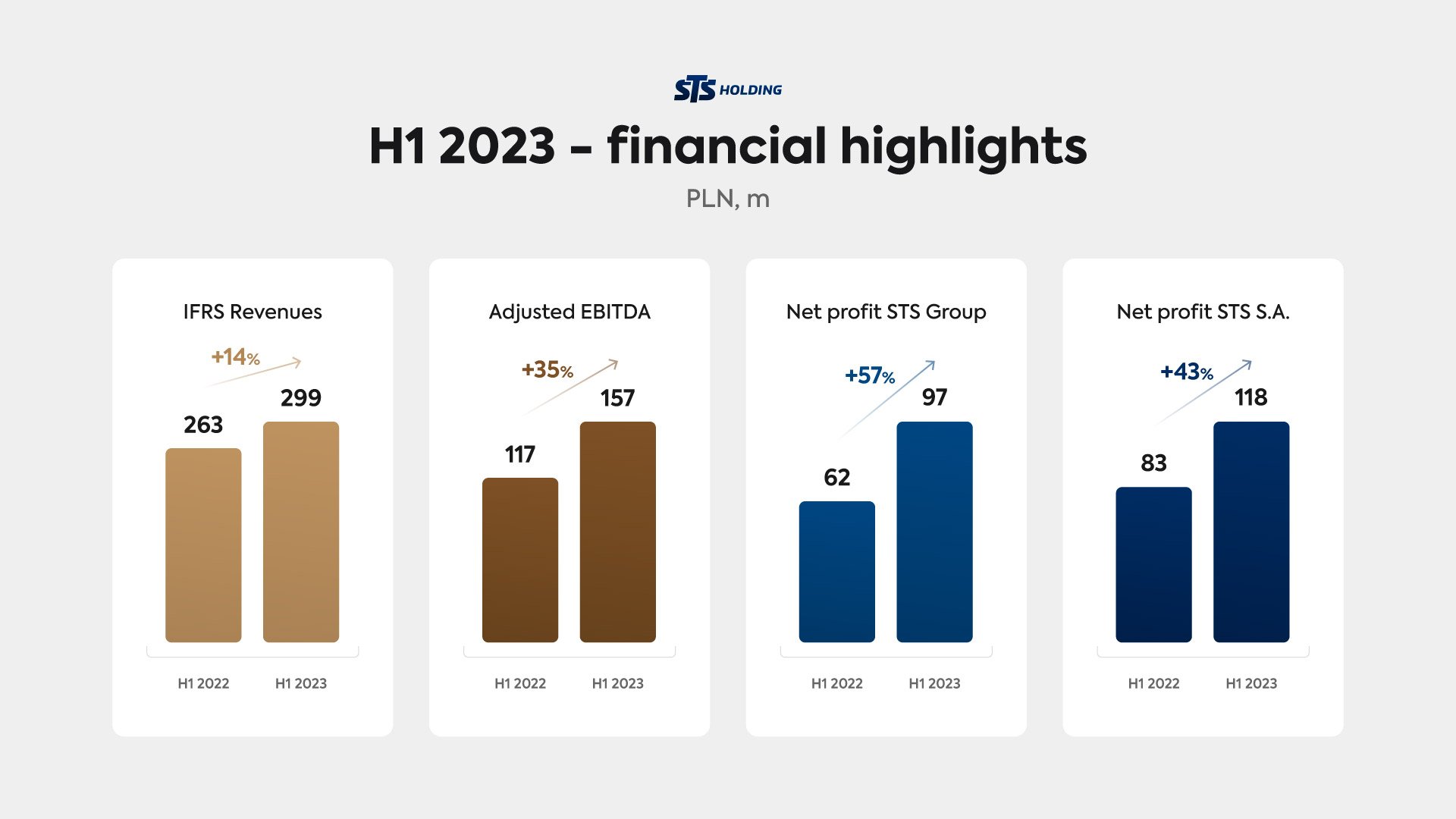

Polish sports betting operator STS Holdings saw an increase of 56.4% in net profit for the first half of 2023 when compared to the previous year, reaching $22.44 million (PLN 97 million).

Additionally, the company reported adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) of $36.32 million (PLN 157 million) for the first half of the year, marking a notable rise of 34.1%.

This positive financial performance comes following the announcement of STS Holding's acquisition by Entain CEE, a subsidiary of online gaming giant Entain PLC. The deal, valued at $935.55 million (£750 million), saw Entain CEE acquire 100% of STS Holding's share capital.

Mateusz Juroszek, CEO of STS, commented on the company's progress during the first half of the year, emphasizing their focus on optimizing operations, which led to improved financial results and an uptick in EBITDA.

"In the second quarter of this year, we continued to optimize processes within the STS Group. Therefore, in H1 of the year we significantly improved both the financial result and the adjusted EBITDA," Juroszek said.

"We assume that in the second half of the year, the activity of our players will be higher, which should have a positive impact on our operational and financial indicators," he added.

While STS did not provide a detailed breakdown of some of its H1 results, it reported that revenue increased by 13.7% to $69.17 million (PLN 299 million) during the period. Notably, the second quarter saw a 26% year-on-year revenue increase.

Net gaming revenue (NGR) for H1 reached $80 million (PLN 346 million), indicating a year-on-year growth of 16.9%. The total value of bets placed by STS Group's clients during H1 2023 amounted to $531.7 million (PLN 2.30 billion), reflecting a 5.1% increase from the previous year.

The company reported having 412,000 active users during the first half of the year, with 109,000 new registrations and 72,000 customers making their first deposits.

During the same period, STS announced its decision to withdraw from some foreign markets, specifically the UK and Estonia, to focus on its operations within the Polish market. This move aimed to leverage the full potential of the local market, which is STS Group's stronghold.