NagaCorp faces $95 million impairment on stalled Russian casino project amid Ukraine war

Cambodian casino operator NagaCorp announced that it will incur an impairment charge of up to $95 million related to its halted gaming and resort project in Vladivostok, Russia. The charge, which stems from complications arising from the ongoing Russo-Ukrainian War, could lead to a significant hit to the company’s earnings for the first half of the year.

The impairment, which is based on an independent revaluation, is expected to range between $85 million and $95 million. This development could potentially result in a net loss for NagaCorp, with the company projecting that its financial outcome for the first six months of 2024 could swing from a profit of $3.1 million to a loss of $6.9 million.

This marks a sharp decline from the $83 million net profit reported in the same period last year.

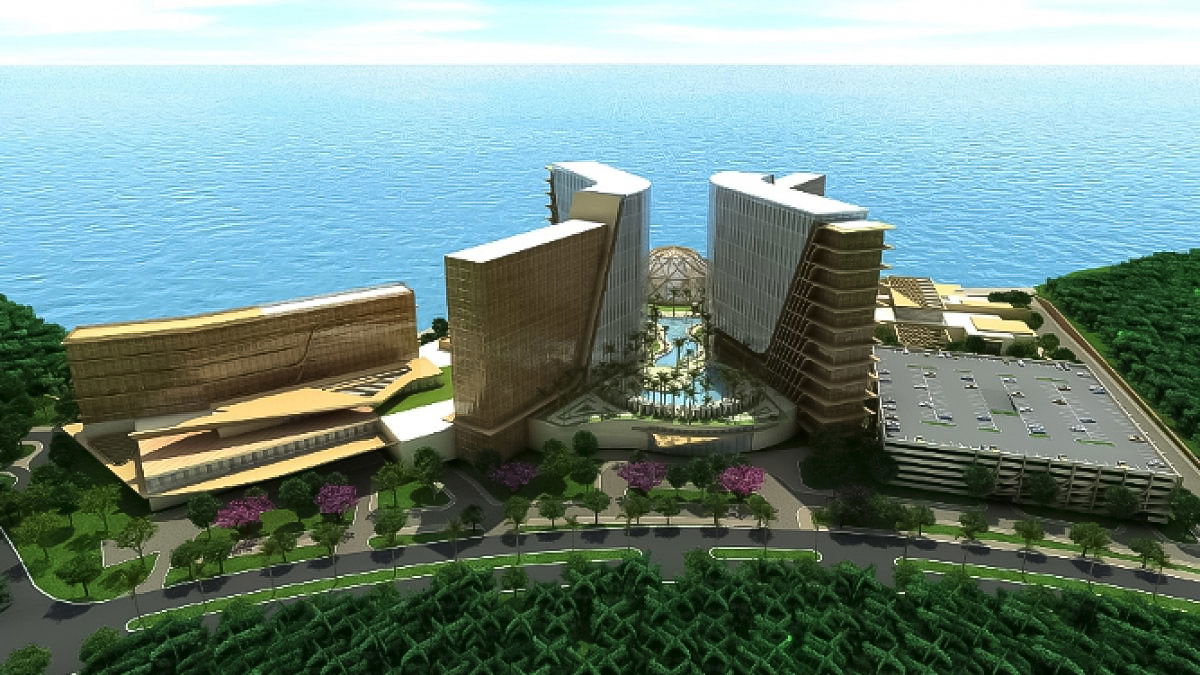

The Vladivostok project, which was envisioned as a key expansion into the Russian market, has been stalled since March 2022. NagaCorp cited the Ukraine war and resulting sanctions against Russia as the primary reasons for the indefinite suspension of the project. Although the company did not initially specify the cause of the halt, its recent filings clearly link the disruption to the geopolitical situation.

Despite this setback, NagaCorp assured investors that its overall financial stability remains intact. Company Secretary Lam Yi Lin emphasized in a statement to the Hong Kong Exchange that "the overall financial position of the group remains healthy."

NagaCorp first announced its intention to enter the Russian market in 2013, committing to invest at least $350 million in Vladivostok's Integrated Entertainment Zone. A groundbreaking ceremony was held in May 2015.

The project was seen as a strategic move to tap into the lucrative markets of nearby China, South Korea, and Japan. However, the shifting global landscape, including Japan's approval of a casino project in Osaka and the broader impact of the COVID-19 pandemic, has altered the project's viability.

As a result of the impairment charge, NagaCorp's shares on the Hong Kong Stock Exchange dropped sharply on Tuesday, reflecting investor concerns. The stock fell by 12% in early trading before recovering slightly to close the day down 4.8% at HK$3.19 ($0.4). This decline adds to the company's ongoing challenges, with its shares having lost over 30% of their value since mid-May.