Illinois sports betting handle falls below $1 billion in June, ending nine-month streak

Illinois' sports betting handle for June fell below the $1 billion mark for the first time in nine months, reaching $848.1 million, according to the Illinois Gaming Board. Despite the decline, the handle was still up 27.4% compared to the same month last year, reflecting continued growth in the state's sports betting market.

The June handle marked a 16.9% drop from the $1.02 billion wagered in May 2024, the last month before Illinois' new progressive tax rate took effect. Of the total bets placed in June, $823.7 million was wagered online, while $24.4 million was bet in person at retail locations.

Bets on professional sports accounted for the majority of the handle, with $839.6 million in wagers, including $815.5 million online. College sports attracted $7.2 million in bets, while motor racing saw $1.3 million in wagers.

Illinois' adjusted gross revenue (AGR) from sports betting in June reached $94.6 million, a significant 72.9% increase year-on-year. This surge was partly due to a $9.1 million adjustment to DraftKings’ revenue for the month, although the details of this adjustment were not fully disclosed.

The overall hold for June stood at 11.2%, with online betting contributing $92.5 million to the total AGR and retail betting accounting for $2.1 million.

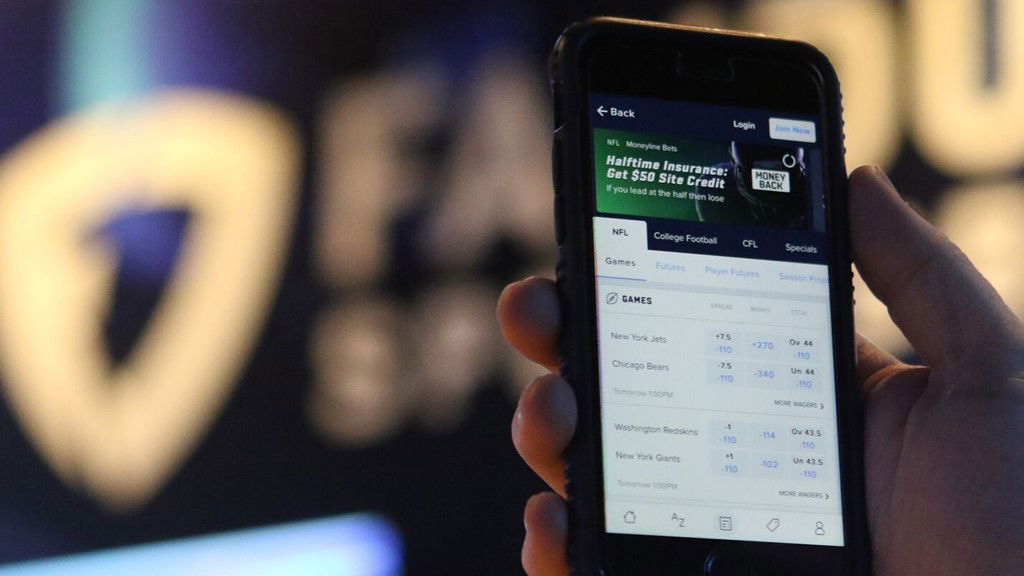

Despite DraftKings' revenue adjustment, FanDuel continued to dominate the Illinois sports betting market. Players wagered $280.5 million through FanDuel, generating $42.9 million in revenue with a strong 15.3% hold.

In contrast, DraftKings' handle was higher at $325.1 million, but its revenue, even with the adjustment, was lower at $39.4 million. Without the adjustment, DraftKings' revenue would have been $28.5 million, reflecting an 8.8% hold.

Rush Street Interactive's BetRivers performed well in its home state, recording $5.8 million in revenue. ESPN Bet followed with $3.8 million, while BetMGM and Fanatics recorded $3.7 million and $3.6 million in AGR, respectively.

June marked the end of Illinois’ fiscal year, with the state's 15% AGR tax rate generating $13.8 million in revenue for the month. However, starting July 1, this tax is replaced by a controversial progressive tax rate. Under the new system, market leaders now face a 40% tax rate on revenue exceeding $200 million, making it the second-highest tax rate in the U.S. after New York’s 51% gross gaming revenue tax.

In response to the higher tax burden, DraftKings announced it would introduce a surcharge on winnings in high-tax states, including Illinois.