Louisiana: tax on online fantasy sports contests heads to governor's desk

The Louisiana State Senate voted 36-0 Tuesday to give final passage to a bill to levy an 8 percent state tax on the net revenue from online fantasy sports contests.

The aim is to dedicate that tax money to early childhood education, though it might only total about $375,000 a year, Houma Courier reports.

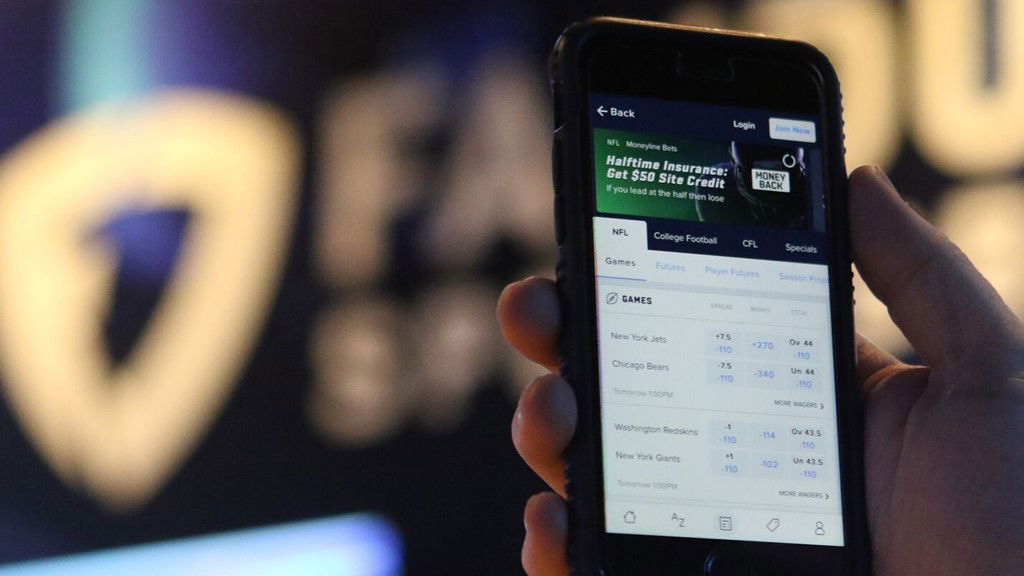

A 2018 law allowed voters in each parish to decide whether or not they wanted to be able to bet on online fantasy sports. Forty-seven of the 64 parishes approved it, including Terrebonne and Lafourche. When fantasy sports betting was legalized, legislators said that it could not take effect unless it was taxed. The enactment of this tax is the last step in allowing residents to bet on fantasy sports.

Sen. Troy Carter, D-New Orleans, said many people are supportive of the bill “specifically because they understand the significance of providing resources to early childhood education.”

A revenue explanation attached to the bill gave a rough estimate of what the state will gain from the tax based on a report of New York’s income from a 15 percent tax on fantasy sports contests. The estimate suggests that Louisiana’s 8 percent tax would result in about $375,000 of yearly tax receipts.

Sen. Kirk Talbot, R-River Ridge said that he is “absolutely committed” to dedicating the tax money to early childhood education. The bill now goes to Gov. John Bel Edwards.